Divorce And Your Money: Does Tax Debt Get Split In A Divorce?

Going through a divorce brings a lot of changes, and figuring out your money situation can be a really big puzzle. One part that often causes a lot of worry, and some confusion too, is how any tax debt gets handled. It's a very common question, you know, "Does tax debt get split in a divorce?" For many people who owe money to the IRS or their state, this question feels super important, and it honestly should.

The way tax debt gets divided up actually depends a lot on where you live. Some places follow what are called community property laws, while others use equitable distribution principles. It's a bit like different sets of rules for the same game, and what your divorce papers say might not be the whole story, especially when the IRS is looking for their money.

So, we're going to walk through what you really need to know about how tax debt might be handled when a marriage ends. We'll look at how state laws play a part, what the tax authorities care about, and some ways you can try to protect yourself. It's about getting a clearer picture, more or less, of this pretty complicated area.

- Who Was The Previous Owner Of The Raiders

- What Is Sean Hannitys Level Of Education

- Who Is The Highest Paid Qb In Nfl History

- Does Gisele Have A New Baby

- Which Football Team Is The Most Profitable

Table of Contents

- Understanding How Debt Is Divided in Divorce

- Protecting Yourself from Your Spouse's Tax Debt

- When Business Taxes Are Involved: S Corporations

- Tax Filing Choices During Divorce

- Getting Professional Help for Tax Debt During Divorce

- Frequently Asked Questions About Divorce and Tax Debt

Understanding How Debt Is Divided in Divorce

When a couple decides to go their separate ways, their shared financial obligations, including any money owed to the tax authorities, become a big point of discussion. It's not always a simple cut-and-dry situation, and there are different rules depending on where you happen to live. Knowing these rules is a first step, in a way, to figuring out your own situation.

Community Property States vs. Equitable Distribution States

The way debts, including tax debt, are split up after a marriage ends really comes down to state law. Some states operate under what are called "community property" rules. In these places, almost everything you and your spouse gained or took on during your marriage, whether it's money, things you own, or debts, is considered to belong equally to both of you. So, in community property states, marital debts, like money owed for taxes, are usually split right down the middle, half and half, between both spouses. This is true, more or less, regardless of who earned the money or who actually created the debt.

Then, you have states that follow "equitable distribution" principles. This is a bit different. Here, the idea isn't necessarily a 50/50 split. Instead, a court will try to divide things fairly, which doesn't always mean equally. They'll look at a lot of different things, like who earned the money, how much each person contributed to the household, their ability to pay, and even who might have incurred the debt in the first place. So, for tax debt, it could mean one person ends up with more of the responsibility than the other, depending on what the court decides is fair. This is why where you live, and the specific types of debt and things you own, will have to be taken into account, you know.

- What Tragedy Happened To Bret Baier

- What Is Ainsley Earhardts Salary

- Who Is The Football Guy With 24 Year Old Girlfriend

- Does Denny Hamlin Own A Helicopter

- Where Does Tom Brady Live Full Time

The IRS's View: What Matters to Them

Here's a really important point that often surprises people: what your divorce papers say about who is responsible for tax debt might not actually matter to the IRS. As far as the IRS is concerned, if you filed a joint tax return, they can try to collect all or any part of the taxes due from either you or your former spouse. This is a big one, because it means even if your divorce decree says your ex-spouse is solely responsible for a certain tax bill, the IRS can still come after you for that money.

You and your former spouse can agree to divide up the debt however you want, and your divorce papers can even make that agreement legally binding between the two of you. But, and this is a big "but," if you get an order from the court splitting the tax obligation, that order will have no effect on the IRS. They aren't bound by your state's divorce laws or your personal agreements. They just want their money, and they can go after anyone who signed that joint return. So, if your spouse doesn't live up to their obligation as stated in your divorce papers, you might still find yourself on the hook with the tax authorities. It's a pretty tough situation, honestly.

Protecting Yourself from Your Spouse's Tax Debt

Given that the IRS can come after either person on a joint return, it's really important to think about ways to protect yourself from your former spouse's share of tax debt. There are some options available, but they require you to be proactive and understand what they mean.

Innocent Spouse Relief: A Key Protection

One very significant way to potentially relieve yourself from paying your spouse's portion of understated taxes from a joint tax return is through something called "Innocent Spouse Relief." This can be a real lifeline if you're no longer married or living together and you believe you shouldn't be held responsible for a tax error or debt that was primarily your spouse's doing.

To qualify for Innocent Spouse Relief, you typically need to show that you didn't know, and had no reason to know, about the understated tax when you signed the joint return. There are specific rules and conditions for this, and the IRS looks at each case individually. It's a pretty complex process, actually, and often requires a lot of paperwork and proof. But if you're worried about back taxes after a divorce, and you feel you were truly unaware of the issues, this is an avenue worth exploring. You can learn more about this on the IRS website, perhaps at irs.gov/individuals/innocent-spouse-relief.

The "Mirroring" Approach for Tax Debt

The text mentions that "the best way to handle tax debt after a divorce is through a process called mirroring." This is a strategy that aims to make sure the tax debt is divided in a way that aligns with how the divorce decree handles other shared financial responsibilities. It's about trying to make the state-level agreement reflect the reality of the tax situation as much as possible, though, as we discussed, it won't change the IRS's direct collection powers.

Mirroring involves making sure that the financial arrangements in your divorce settlement directly address how any existing or potential tax liabilities will be paid. For instance, if one spouse is taking on a larger share of assets, they might also agree to take on a larger share of the tax debt. It's about creating a clear plan within the divorce agreement for how these tax bills will be settled between the former spouses, rather than leaving it vague. This can help prevent future disputes and provide a framework for accountability between the parties, even if the IRS still has its own collection methods.

When Business Taxes Are Involved: S Corporations

For those who own businesses, especially something like an S corporation, divorce can bring another layer of tax debt questions. During divorce proceedings, a family court judge might look at the profit from an S corporation as the owner's personal income. At the same time, the judge will also consider the personal impact of any tax debts that come from this business. It's a very specific kind of problem, you know.

This can get very, very complicated. For example, if the S corporation has a tax debt, how does that affect the personal income of the owner? And how does that personal income then get divided in the divorce? These are pretty intricate issues, and they absolutely need to be talked about with an attorney who really understands both divorce law and tax law, especially for businesses. Trying to figure this out on your own could lead to even bigger tax problems on top of the stress of getting through your divorce.

Tax Filing Choices During Divorce

Your tax filing status can also be a bit tricky during a divorce. If you filed for a divorce before the last tax year ended, but the divorce wasn't final in that year, you and your spouse actually still have the option to choose "married, filing jointly" on your federal tax return. This might seem odd, but it's often a choice that can save money in taxes for both parties, as joint filing typically offers better tax rates and deductions.

However, choosing to file jointly when you're in the middle of a divorce means you are both still equally responsible for any tax debt that comes from that joint return, as we've discussed. So, while it might offer tax benefits, it also carries a significant risk if you can't trust your soon-to-be ex-spouse to handle their share of the tax burden. It's a decision that really needs careful thought and perhaps some professional advice, you know, before you make it.

Getting Professional Help for Tax Debt During Divorce

It's pretty clear that dealing with tax debt during a divorce is anything but simple. There are so many tax questions that come up during a divorce, and "is tax debt split in divorce?" is certainly one of the most common ones. Many people who owe taxes to the IRS or their state, perhaps like in New Jersey, wonder about this very thing.

The best advice, truly, is to consult a tax attorney. They can help you determine the best way to handle your tax debt during your separation or divorce. They understand how different types of debts are divided up between spouses during divorce, and they can offer specific guidance based on your state's laws and your unique financial situation. For instance, a firm might offer tax settlement help for both federal and state tax debt, including assistance with those innocent spouse relief requests.

Understanding how responsibility for debt is split in a divorce is incredibly important for your financial future. You don't want to create more tax problems on top of everything else you're going through. Protecting your assets and making sure you understand your obligations are key steps. You can learn more about divorce and finances on our site, and perhaps even link to this page financial separation for more specific information.

Frequently Asked Questions About Divorce and Tax Debt

Can a divorce decree protect me from my ex-spouse's tax debt?

No, not entirely. While your divorce decree might state that your ex-spouse is responsible for a specific tax debt, that agreement is only binding between the two of you. As far as the IRS is concerned, if you filed a joint tax return, they can still try to collect the full amount of the debt from either you or your former spouse. It's a tough reality, but it's how the tax authority operates.

What if my ex-spouse doesn't pay the tax debt they agreed to in the divorce?

If your ex-spouse doesn't live up to their obligation as outlined in your divorce papers, the IRS can still come after you for the full amount if it was a joint debt. Your recourse would then be to take legal action against your ex-spouse in state court to enforce the divorce decree. This means you might have to pay the IRS first and then try to get reimbursed by your ex, which can be a long and difficult process.

Is there a way to avoid being responsible for my ex-spouse's tax debt from a joint return?

Yes, there is a possibility. You might be able to apply for something called "Innocent Spouse Relief" with the IRS. This can potentially free you from paying your spouse's share of certain tax debts from a joint return if you can show you didn't know about the issues that led to the debt. It's a very specific application process with strict rules, so getting help from a tax professional is usually a very good idea for this.

- What Car Does Michael Douglas Drive In The Game

- Who Has The Most Super Bowl Losses

- Who Is Andy Reids Twin Brother

- How Many People Own The Raiders

- Who Is The Least Popular Team In The Nfl

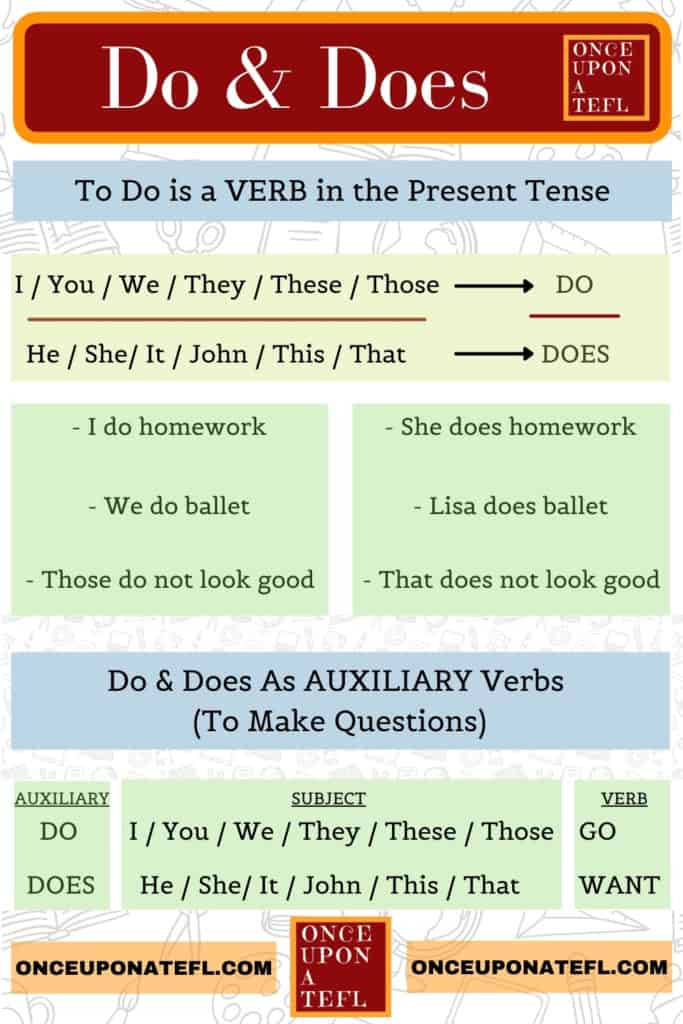

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES