When You Get Married, Does Your Spouse's Debt Affect You? Unpacking The Financial Truths

Stepping into marriage often feels like starting a brand new chapter, a fresh beginning filled with shared dreams and joint plans. Yet, it's pretty common for folks to wonder about the financial aspects, especially when it comes to money matters that existed before the big day. A really big question that pops up for many is whether or not your partner's existing financial obligations suddenly become your own once you say "I do." It's a completely fair concern, and one that can cause a bit of worry, as a matter of fact.

It's natural to feel a little uneasy about the idea of taking on someone else's money troubles, even if that someone is your beloved spouse. After all, financial burdens can really eat into your earnings, they can bring down your credit standing, and they are capable of causing a whole lot of stress in your daily life. You might be newly married, or perhaps you are thinking about tying the knot, and you just found out your partner brought a good deal of debt into the marriage, so you might ask yourself, am I responsible for it?

There are many ideas floating around about marriage and debt, and some of them are simply not true. So, we're going to check out the facts and clear up some common myths related to this very question. This article will help you learn whether you are indeed responsible for your spouse's financial obligations after marriage, and it will also explain what happens to any new debts you both might take on during your married life together, you know, as things progress.

- How Rich Is Bridget Moynahan

- What Is Greg Gutfelds Salary

- Who Has The Most Coach Wins In History

- How Much Is Hannitys House Worth

- How Much Is Fox Paying Tom Brady To Broadcast

Table of Contents

- Understanding Debt Before Marriage

- Debt Incurred During Marriage: Common Law vs. Community Property

- Community Property States: What You Need to Know

- The Impact on Your Credit Score

- Joint Loans and Cosigning: A Special Case

- Tax Filing Status and Student Loans

- Navigating Financial Stress Together

- Frequently Asked Questions

Understanding Debt Before Marriage

When you get married, the simple act of saying "I do" generally does not make you accountable for your partner's existing financial obligations. This is a pretty common misconception, but in almost every situation, you won't be held responsible for debt your spouse had before your marriage. Any debts either person had before the wedding day typically remain their own sole responsibility, with just one notable exception, you know, that really important one.

So, if you are newly married and perhaps just found out your partner brought a lot of debt into the marriage, you might be asking yourself, "Am I responsible for it?" The general answer is no, you are not. Your partner's credit card debt incurred before the marriage, for instance, usually stays with them. This means that your individual financial history and their individual financial history remain separate for those pre-existing burdens, at least at the start, anyway.

One spouse's financial burdens from before the marriage do not automatically become the other's just by signing a marriage license. This is a pretty significant point for many couples. However, even if you are not directly liable for that pre-marital debt, it can still, in some respects, affect you after you are married. It's something to think about, you know, how it might indirectly play a role in your shared financial life.

- Who Is The Highest Paid Qb In Nfl History

- How Much Are 2026 Super Bowl Tickets

- Where Is The 2028 Super Bowl

- Who Is The Richest News Anchor

- How Much Does Patrick Mahomes Make

Debt Incurred During Marriage: Common Law vs. Community Property

The question of whether you share financial obligations after marriage gets a bit more involved when we look at debt taken on *during* the marriage. This is where the laws of the state where you live really come into play. Most states in the country use what is called common law, also known as equitable distribution, which means that married couples don't automatically share all personal property legally, so that's a key distinction.

In common law states, financial burdens taken on after marriage are usually treated as being separate. They belong only to the spouse who actually incurred them. So, in other words, you typically aren't responsible for your spouse's financial obligations unless you both took it out together as a joint account, or if you actually put your name on it as a cosigner. This distinction is quite important for many couples, you see, as it shapes who is on the hook for what.

However, there's a completely different approach in what are called community property states. These states view marriage as a complete financial partnership, so you really do share the debt liability with your spouse in a more direct way. In these particular states, most financial obligations incurred during the marriage become "community debt," which means that both spouses are equally responsible for them, even if your name isn't actually on the paperwork, that's really something to consider.

For example, in a community property state, if a claim arose during the marriage, a creditor might be able to collect your spouse's unpaid credit card debt from both halves of what is considered community property. This can even include your wages, which is a pretty significant impact. So, the distinction between common law and community property states is quite important for figuring out how marriage affects your financial responsibilities, you know, when new debts come up.

Community Property States: What You Need to Know

As of 2025, there are currently nine community property states where this different set of rules applies. In these places, the idea is that marriage creates a joint financial pool, so what one person earns or owes during the marriage belongs to both, in a sense. This means that debts incurred by either spouse while married are generally considered community debts, and both individuals are equally on the hook for them, even if only one person's name is on the original paperwork, you know, the actual loan agreement.

This approach means that if a couple in a community property state gets divorced, all community debts are typically divided equally between the spouses as part of the divorce decree. It's a pretty straightforward division of responsibility for those shared financial burdens. However, it's important to remember that a divorce decree does not actually alter the original contract with the creditor, so that's a very specific point to keep in mind.

So, even if a divorce court says one spouse is responsible for a particular debt, the original lender can still pursue both parties if both were liable under community property law. This is a very key distinction. The court's ruling is about how the spouses divide things between themselves, but it doesn't change the agreement with the bank or the credit card company, you know, the one they signed originally.

The Impact on Your Credit Score

Many people worry about how getting married might affect their individual credit standing. The good news is that simply tying the knot won't directly affect your credit rating. Your personal credit report and score remain separate from your spouse's. However, how you both manage financial obligations as a couple can certainly have an impact on your scores over time, that's something to really consider.

It's helpful to learn about how both spouses' financial burdens can influence your scores, especially when you start making joint financial decisions. Even if you are not legally responsible for your spouse's debt, and it doesn't appear on your own credit report, your spouse's financial troubles can still affect you indirectly. This happens most often when you want to apply for a loan or a line of credit together, you know, as a married pair.

For instance, if your spouse has a low credit score because of their past financial issues, it could make it harder for both of you to get approved for a mortgage or a car loan with favorable terms. Lenders look at the combined financial picture when you apply jointly. It's a pretty practical consideration for many couples. You really want to understand the facts about credit scores in marriage, and how they work, as a matter of fact.

There are tips to improve a less-than-ideal credit standing by working together as a team. This means open discussions about financial goals and challenges. It's about figuring out a plan to tackle any existing financial burdens and building a strong financial future as a unit. This collaborative approach can really make a difference, you know, in the long run.

Joint Loans and Cosigning: A Special Case

There's a very important exception to the general rule that you aren't responsible for your spouse's pre-marital financial obligations. This comes into play if you cosign a loan for your significant other or if you open a joint account on a credit card before you officially tie the knot. In these specific situations, you are both fully responsible for the debt after your marriage date, and that's a really big deal.

This means that if your partner doesn't make the payments, the lender can come after you for the full amount, regardless of whether you were married or not when the debt was originally taken out. The act of cosigning or opening a joint account signifies that you are agreeing to share that financial burden. It's a direct agreement with the creditor, so that's something to be very aware of.

This principle also applies to certain types of loans like student loans. Your spouse is not responsible for student loans from before the marriage unless they actually cosign on the loan. So, if your partner had student loans before you got married, and you didn't put your name on them, those loans remain their individual responsibility. It's pretty straightforward in that sense, you know, unless you explicitly agree to share.

So, in essence, you aren't responsible for your spouse's financial obligations unless you took it out together as a joint account, or you personally cosigned on it. This is the key takeaway for both pre-marital and marital debts in many situations. It highlights the importance of being very careful and informed before putting your name on any financial agreement with your partner, or really, with anyone, you know, for that matter.

Tax Filing Status and Student Loans

Your income tax filing status can also affect the amount you repay on certain types of loans, particularly student loans. When you are married, you have a choice: you can either file a joint income tax return with your spouse, or you can file separately. This decision can have some pretty significant implications for your financial situation, especially if one or both of you have student loan debt, so it's worth thinking about.

Under most income-driven repayment (IDR) plans for student loans, lenders will generally use your joint income if you and your spouse file a joint tax return. This combined income usually raises the monthly payment for the student loan. However, some plans might reduce your payments to account for your spouse's student loan debt if you file taxes in a certain way, like separately, you know, to keep incomes distinct.

Married borrowers have the option to file separately to keep their income separate from their spouse’s for certain repayment plans. This can be a strategic move to potentially lower student loan payments, as the calculation would then be based only on the individual borrower's income. It's a way to manage the impact of student loan debt on your household finances, especially if one spouse has a significantly higher income or larger loan balance, you know, to balance things out.

It's important to remember that while one spouse’s premarital debt, like student loans, does not automatically become the other’s upon signing a marriage license, that debt can still affect you after marriage through these indirect ways. Your income tax filing choice is a prime example of this. It's a financial decision that requires careful thought and discussion between partners, you know, to make the best choice for both of you.

Navigating Financial Stress Together

Since financial burdens can really eat into your income, lower your credit standing, and cause a lot of financial stress, it's completely fair to feel uneasy about the possibility of being liable for someone's debt. This is true even if this someone is your spouse. Debt is, in fact, one of the most common problems an individual can bring into a marriage, and it can definitely test a relationship, you know, in many ways.

Open and honest conversations about finances are really key. This includes discussing any existing debts, how you plan to manage money together, and what your financial goals are as a couple. It's about creating a shared financial vision and working as a team to achieve it. This kind of communication can help ease some of that financial worry, you know, that often comes with debt.

Even if you are not directly on the hook for your spouse's debt, their financial woes can still affect your shared life. This is why it's so important to work together on improving any less-than-ideal credit situations or managing existing financial burdens. By tackling these issues as a united front, you can build a stronger financial foundation for your marriage. It's basically about supporting each other, you see, through thick and thin.

Learning about the facts of marriage and debt, and how your credit scores might be influenced, is a great first step. Then, putting those insights into practice by openly discussing finances and creating a plan can really help. It's about building a partnership that extends to every part of your lives, including the money side of things. That's how many couples find peace of mind, you know, when it comes to finances.

Frequently Asked Questions

Here are some common questions people ask about financial obligations and marriage, with straightforward answers based on what we've discussed.

Am I responsible for my spouse’s credit card debt incurred before marriage?

Generally, you are not responsible for your spouse's credit card debt that was incurred before your marriage. Any financial obligations either spouse had before the wedding usually remain their individual responsibility. The act of getting married does not automatically transfer that debt to you, you know, in most cases.

Are you responsible for your spouse's debt after marriage?

It really depends on the type of debt and where you live. In common law states, debts taken on after marriage are typically separate and belong to the spouse who incurred them, unless you cosigned or opened a joint account. However, in community property states, most debts incurred during the marriage are considered joint and both spouses are equally responsible, even if your name isn't on the paperwork, you know, for that specific item.

What happens when you marry someone with debt or bad credit?

- Does Tom Brady Pay Child Support

- What Teams Are Going To Las Vegas In 2025

- How Much Is The Raiders Owner Worth

- Is The Nfl Getting Rid Of Jay Z

- Where Does Gisele Brady Live Now

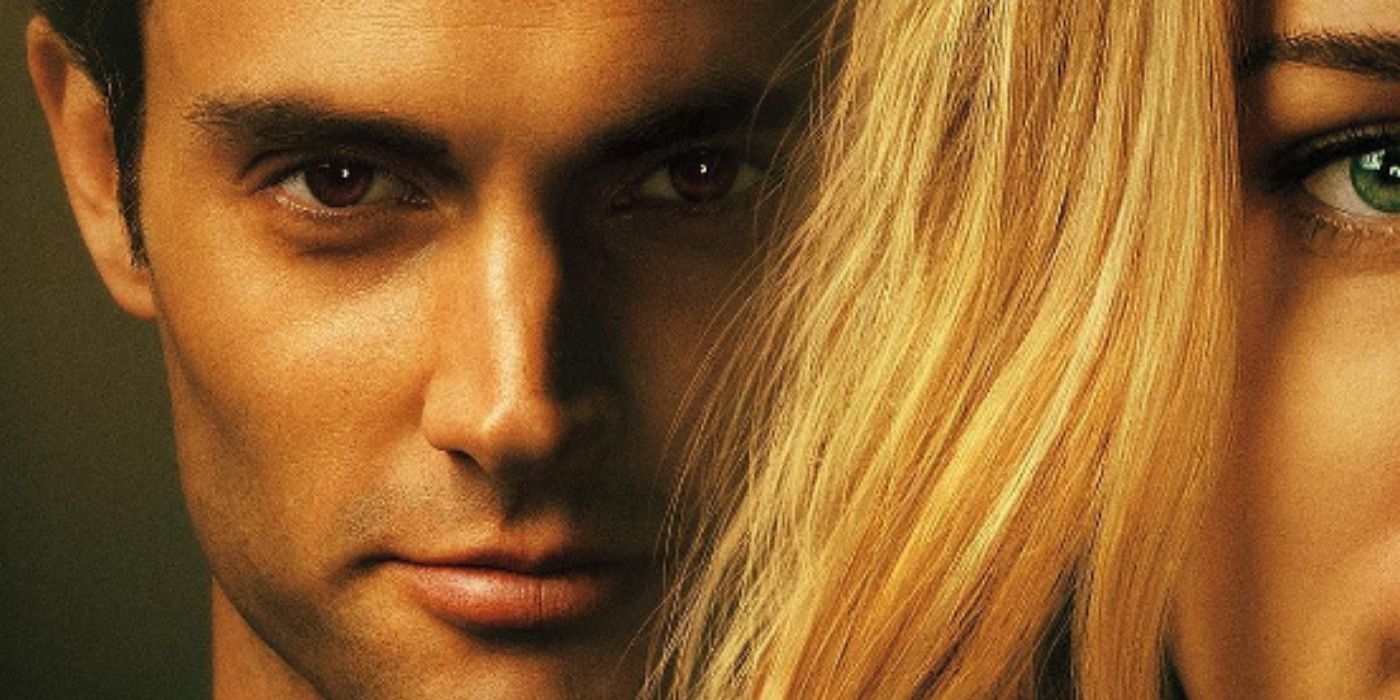

You (2018)

YOU Season 3: Release Date, Cast & Story Details | Screen Rant

YOU Season 2 Cast & Character Guide | Screen Rant