Your Local Financial Partner: Exploring Wayne Westland Federal Credit Union

Finding a financial home that truly understands your needs, a place where you're more than just an account number, really matters. It's almost like seeking a community anchor, a spot where support for local folks is a big deal. For many in the area, a name that often comes up in conversations about reliable, community-focused financial services is Wayne Westland Federal Credit Union. This credit union, serving its members right here in the Wayne and Westland communities, aims to be that kind of supportive financial hub.

You see, when it comes to managing your money, having a partner that puts your well-being first can make a huge difference. It's not just about transactions; it's about building a relationship, getting advice that helps you grow, and knowing your financial institution is invested in the very place you call home. That, in a way, is what a local credit union strives to do.

So, if you're curious about what makes a federal credit union stand out, or perhaps you're thinking about where your money could feel more at home, exploring the unique approach of a place like Wayne Westland Federal Credit Union might just be what you're looking for. It's a bit different from your typical bank, offering a distinct kind of financial experience that many people find quite appealing.

- Cooper River Bridge Run

- Lubbock Avalanche Journal

- Altoona Police Department Pa

- Weather Newburgh Ny

- Huron County Circuit Court

Table of Contents

- What is a Federal Credit Union?

- Why Choose a Local Credit Union Like Wayne Westland?

- Common Services You Might Find

- Becoming a Member: It's Simpler Than You Think

- Financial Wellness and Support

- Frequently Asked Questions About Credit Unions

- Ready to Explore Your Options?

What is a Federal Credit Union?

A federal credit union, like the one serving the Wayne and Westland areas, is a financial cooperative. This means it is owned by its members, not by outside shareholders. It's a pretty unique setup, actually, that puts the members' financial health at the very core of its mission. Unlike a big bank, which usually aims to make profits for its investors, a credit union's main goal is to serve its members well.

This structure, you know, allows credit unions to operate a bit differently. They often return profits to members through things like lower loan rates, higher savings rates, and fewer fees. It's a system that, in some respects, feels much more focused on people than on pure earnings.

Member Ownership Matters

When you join a credit union, you actually become a part-owner. This isn't just a fancy title; it means you have a say in how the credit union is run. Members typically elect a volunteer board of directors from among themselves, and these directors then guide the credit union's policies and decisions. It's a truly democratic financial model, which is rather different from a typical bank.

This direct involvement means the credit union's focus is always on what benefits its members most. It's a structure that, in a way, builds a stronger sense of trust and shared purpose. You are not just a customer; you are a stakeholder, and that is a very important distinction.

A Focus on Community

Credit unions are deeply rooted in the communities they serve. For Wayne Westland Federal Credit Union, this means a strong connection to the people and places of Wayne and Westland. They often get involved in local initiatives, support community events, and truly understand the financial needs of the residents. This local connection is a big part of their identity.

It's similar, in some respects, to how Wayne State University, from the heart of Detroit, expands access to care where it’s needed most and trains Michigan’s next generation. A credit union, too, provides access to financial services where they are needed most, helping to build up the economic health of its local area. They are often committed to providing fair and equal opportunity to all members, which is a key community value.

Not-for-Profit, For You

The "not-for-profit" status of federal credit unions is a huge advantage for members. Instead of distributing profits to shareholders, any earnings are reinvested back into the credit union. This helps to improve services, offer better rates, and keep fees low. It's a financial model designed to benefit the people who use it, directly.

This means that when the credit union does well, its members benefit. It's a continuous cycle of improvement and value, which is pretty good for anyone looking for a financial partner. You could say, it's a financial institution truly built for its members, by its members.

Why Choose a Local Credit Union Like Wayne Westland?

Choosing a financial institution is a very personal decision, and there are many reasons why a local credit union might be the right fit. For people living or working in the Wayne and Westland areas, a place like Wayne Westland Federal Credit Union offers specific advantages that big national banks often can't match. It's about getting a different kind of financial experience, one that feels much more connected to you.

Personalized Service: A Real Difference

One of the most talked-about benefits of credit unions is the level of personalized service they offer. Because they are smaller and community-focused, staff often know their members by name and can provide more tailored advice. This means less waiting on hold and more direct, helpful conversations about your financial goals. It's a very human touch.

This kind of service can be incredibly reassuring, especially when you have important financial questions or needs. It's like having a trusted advisor right in your neighborhood, someone who truly cares about your success. You know, they are often really good at understanding individual situations.

Better Rates and Fewer Fees

As mentioned, credit unions typically offer more favorable rates on loans and savings accounts compared to traditional banks. This is because they aren't driven by shareholder profits. They can pass those savings directly to their members. So, you might find lower interest rates on auto loans or mortgages, and higher interest rates on your savings. That is a pretty big deal for your money.

Additionally, credit unions often have fewer fees, and the fees they do have are usually lower. This can add up to significant savings over time. It's a straightforward way to keep more of your hard-earned money in your pocket, which is always a good thing, really.

Investing in the Local Area

When you bank with a local credit union, your money stays within the community. The loans they provide often go to local businesses and residents, helping to stimulate the local economy. This creates jobs, supports local growth, and strengthens the overall financial health of the area. It's a direct way to contribute to where you live.

This local investment is a core part of the credit union philosophy. It's about building a stronger community, one financial decision at a time. This is very much in line with the spirit of institutions like Wayne State University, which also invests heavily in the local Detroit community by training health professionals and driving research that leads to positive change.

Common Services You Might Find

Just like larger banks, federal credit unions offer a wide range of financial products and services designed to meet the everyday needs of their members. While the specific offerings can vary, you can generally expect to find all the essential tools you need to manage your money effectively. It's quite comprehensive, you know.

Savings and Checking Accounts

These are the foundational services for any financial institution, and credit unions are no different. You'll typically find various options for savings accounts, from basic savings to money market accounts, often with competitive interest rates. Checking accounts usually come with features like debit cards, online bill pay, and mobile access. They are pretty much what you would expect, but with a member focus.

The goal is to provide easy and secure ways for members to manage their daily finances and save for the future. Many credit unions also offer specialized accounts, perhaps for youth or for specific savings goals, which is pretty helpful for different life stages.

Loans for Life's Big Moments

Whether you're looking to buy a car, purchase a home, or finance a major expense, credit unions offer a variety of loan products. This includes auto loans, mortgages, personal loans, and sometimes even student loans. As mentioned, these often come with more attractive interest rates than what you might find elsewhere, which is a real benefit.

The loan application process often feels more personal too, with loan officers who take the time to understand your situation and guide you through the options. It's a very supportive approach to helping members achieve their goals, which is important when you're making big financial decisions.

Convenient Digital Tools

In today's world, digital banking is a must, and credit unions have invested heavily in providing convenient online and mobile services. You can typically manage your accounts, pay bills, transfer funds, and even apply for loans right from your smartphone or computer. This makes banking easy and accessible, no matter where you are. It's very much about keeping up with how people live now.

While the human touch is a hallmark of credit unions, they also understand the importance of technology for everyday banking. So, you get the best of both worlds: personal service when you need it, and digital convenience for everything else. This combination is, in some respects, quite powerful for members.

Becoming a Member: It's Simpler Than You Think

Some people might think joining a credit union is complicated, but it's actually quite straightforward. The process is designed to be welcoming and easy, helping new members quickly gain access to all the benefits. It's often just a few steps, really.

Who Can Join?

Each credit union has a specific "field of membership," which defines who is eligible to join. For a credit union like Wayne Westland Federal Credit Union, this typically means people who live, work, worship, or attend school in the Wayne and Westland areas. Sometimes, family members of current members are also eligible. This focus on a specific community is what helps keep the credit union truly local.

You can usually find information about eligibility on their website or by simply giving them a call. It's a good idea to check this first, just to make sure you meet the criteria. But for most people in the local area, it's generally pretty easy to join.

The Joining Process Explained

Once you confirm your eligibility, becoming a member usually involves opening a savings account with a small initial deposit, sometimes as little as $5. This deposit establishes your share in the credit union, making you a part-owner. From there, you can open other accounts or apply for loans as needed. The process is designed to be very welcoming, you know.

You might be able to start the process online, or you can visit a branch in person. Credit union staff are typically very helpful and can guide you through each step. It's all about making financial access easy and comfortable for new members, which is pretty important.

Financial Wellness and Support

Beyond just offering accounts and loans, federal credit unions often play a larger role in promoting the financial well-being of their members and the community. This goes back to their core mission of serving people, not just making money. It's a very supportive approach, actually.

Guidance and Education for Everyone

Many credit unions provide resources and guidance to help members improve their financial literacy. This could include workshops on budgeting, credit counseling, or advice on saving for retirement. They aim to empower members with the knowledge they need to make smart financial decisions throughout their lives. This kind of support is very valuable, especially for younger people or those just starting out.

It's similar to how Wayne State University provides training at more than 70 clinical sites, offering students a variety of learning experiences. A credit union, too, offers a kind of financial training, helping members gain skills and knowledge for a better financial future. This program mentors and trains members to become financially savvy community members, which helps reduce financial disparities.

Helping the Community Thrive

The commitment to community runs deep within the credit union philosophy. By offering fair financial services and supporting local initiatives, credit unions contribute to the overall economic health and stability of the areas they serve. This means a stronger local economy, better opportunities for residents, and a more vibrant place to live. It's a tangible way they give back, you know.

This dedication to local impact is a distinguishing feature. It's about fostering growth and stability right where it matters most, in the heart of the community. So, choosing a local credit union is, in a way, also choosing to support your neighbors and your local area.

Frequently Asked Questions About Credit Unions

People often have questions when they first learn about credit unions. Here are some common ones that come up:

Are credit unions insured?

Yes, federal credit unions are insured by the National Credit Union Administration (NCUA), a U.S. government agency. This insurance protects your deposits up to $250,000 per member, per account ownership type, just like FDIC insurance at banks. So, your money is safe, which is very reassuring.

Can anyone join a credit union?

While credit unions have a "field of membership," it's often quite broad. For a local credit union like Wayne Westland Federal Credit Union, this usually includes anyone who lives, works, worships, or attends school in the specific geographic area they serve. Family members of current members are also often eligible. It's generally pretty inclusive for the local community, actually.

How do credit unions differ from banks?

The main difference is ownership and purpose. Banks are for-profit institutions owned by shareholders, aiming to maximize profits. Credit unions are not-for-profit cooperatives owned by their members, aiming to serve members' financial needs. This often leads to better rates, lower fees, and more personalized service at credit unions. It's a very different approach to finance, you know.

Ready to Explore Your Options?

If you're looking for a financial partner that puts your needs first, invests in the community, and offers a personal touch, then learning more about a place like Wayne Westland Federal Credit Union could be a great next step. It's about finding a place where your money truly feels at home, and where you feel like a valued part of something bigger. You can learn more about credit union benefits on our site, and perhaps find a local branch to visit. Or, to explore more about how local financial institutions support their communities, check out this page about community financial support. For general information on credit unions and their role, you might visit the National Credit Union Administration website.

- Msu Basketball Score

- Clear Lake Iowa

- Yard House Beer Menu

- Lansing Board Of Water And Light

- Best Onlyfans Leaks

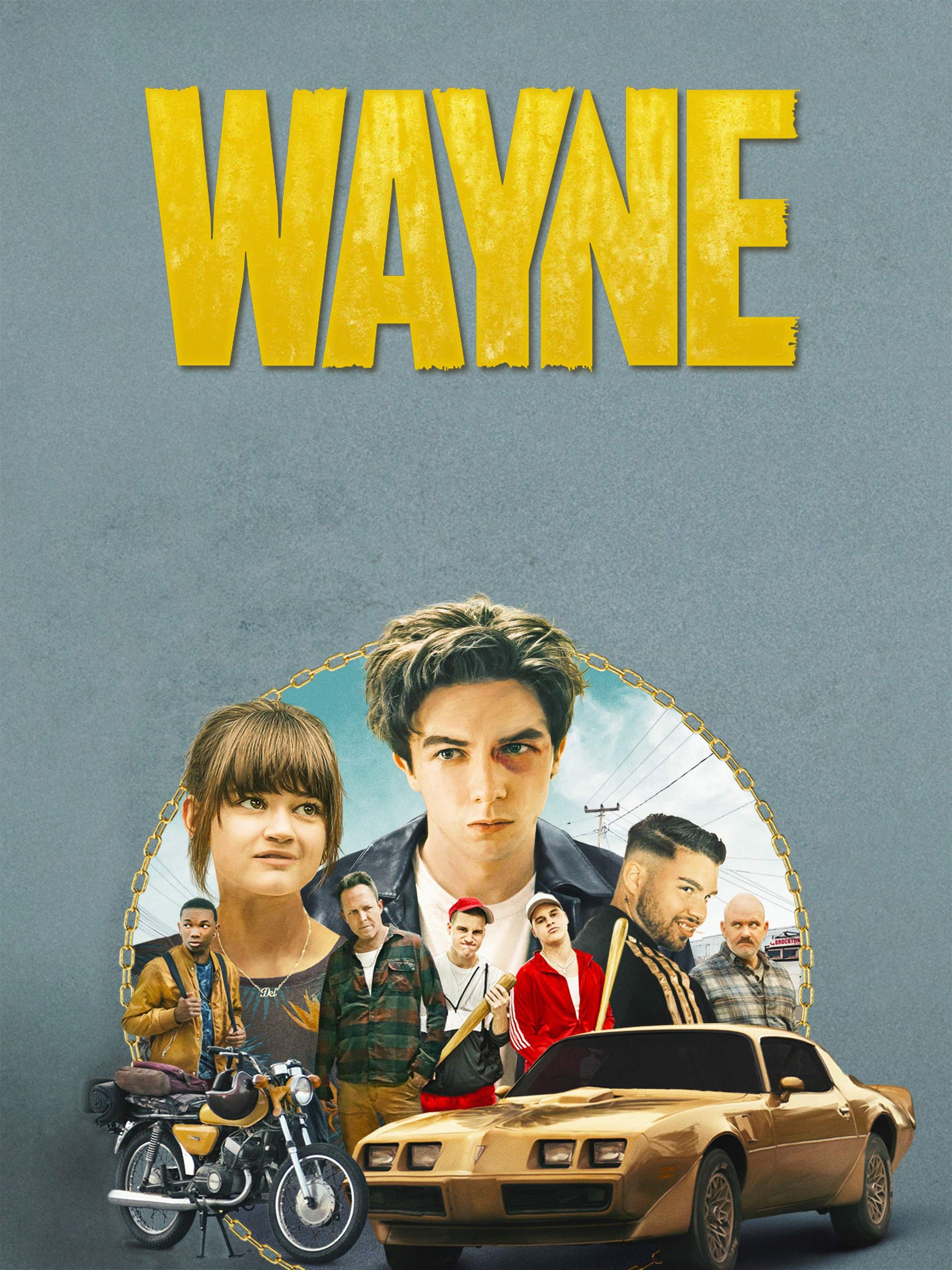

Wayne Season 2 - Will It Ever Happen?

Wayne | Television Reviews

Wayne - Rotten Tomatoes