Unpacking Albert Flamingo Snapchat: Your Guide To Smarter Money Habits

Have you ever typed "albert flamingo snapchat" into a search bar, just wondering what pops up? It's a pretty interesting phrase, isn't it? People are often looking for new ways to handle their money, and sometimes, they use unique terms to find what they need, so. This particular search might make you curious about how a popular money app, Albert, could connect with something as fun and vibrant as a flamingo, or even with the quick-paced world of Snapchat.

You see, managing your money well can sometimes feel like a big puzzle. Finding tools that make it easier is something many of us want, you know. That's where apps like Albert step in, offering a way to keep track of your cash without a lot of fuss. It's about making your financial life a bit smoother, actually.

This article will look at what Albert does and how it can help you get a better grip on your finances. We'll also consider how a tool like this fits into your everyday digital life, perhaps even alongside your favorite social apps, like Snapchat, at the end of the day. It's pretty cool, in a way.

- North Port Fl Weather

- Wesley Snipes And Halle Berry

- Razorback Football 247

- I 80 Iowa Road Closure

- Bella Due%C3%B1as Onlyfans

Table of Contents

- What's the Deal with Albert Flamingo Snapchat?

- Getting to Know Albert: Your Money Companion

- Budgeting and Tracking Made Simple

- Smart Savings and Investing

- Genius Advice and Support

- Keeping Your Money Safe

- How Albert Fits into Your Digital Life (Even on Snapchat)

- Starting Your Albert Adventure

- Common Questions About Albert

What's the Deal with Albert Flamingo Snapchat?

The phrase "albert flamingo snapchat" is quite catchy, isn't it? It might make you wonder if there's a special feature involving a pink bird, or if it's some kind of inside joke among users. While Albert itself is a serious tool for money management, people often come up with fun ways to talk about the things they use daily, sometimes even giving them nicknames, you know.

This search query, "albert flamingo snapchat," truly highlights how people look for information in all sorts of ways. It could be someone remembering a quirky ad, or maybe just a memorable phrase they heard, so. The main thing to remember is that Albert is a financial app, plain and simple, designed to help you with your money, which is pretty useful.

So, if you're looking up "albert flamingo snapchat," you're likely interested in the Albert app. It's a tool built to help you take charge of your finances. This includes budgeting, saving, spending, and even investing, all from one handy spot, more or less. It's a pretty powerful app, honestly.

- Stephen Breadman Edwards

- Gonzo The Great

- Lorain Ohio Weather

- United Airlines Flight 175

- Weather Greensburg Pa

As of [Current Month, Current Year], many people are using Albert. In fact, over 10 million people have joined the Albert community. That's a lot of folks looking to make their money work better for them, you see. It's a widely used tool, which is pretty neat.

The "flamingo" part could just be a fun, memorable way to refer to the app, perhaps suggesting your finances can truly "take flight" with Albert's help. It's a whimsical thought, isn't it? Anyway, the core idea is about getting your money in order, and Albert aims to help you do just that.

And the "Snapchat" part? Well, people spend a lot of time on their phones, sharing moments and connecting with friends. A money app that lives on your phone, ready when you need it, fits right into that mobile-first lifestyle, in a way. It's about convenience, basically.

It's about having your financial tools right where you need them, ready to use in quick moments, just like you might check a Snapchat story. This ease of access is a big part of why mobile finance apps are so popular, you know. They fit into our busy lives, pretty much.

Getting to Know Albert: Your Money Companion

Albert is much more than just a place to keep track of your spending. It's a comprehensive tool that aims to simplify your entire financial picture. From the very basics of budgeting to making your money grow, it brings several key features together in one convenient app, so. It's like having a financial assistant right in your pocket, honestly.

The app is built to be incredibly powerful, giving you control over different parts of your money life. This means you can get a clearer view of where your cash goes and where it could be going, which is pretty helpful. It's about seeing the whole picture, you know.

You can manage your budget, save up for goals, handle your daily spending, and even put money into investments. All of these functions are available within the same app, which makes things a lot simpler, to be honest. It really streamlines your financial tasks, pretty much.

Budgeting and Tracking Made Simple

One of the main things Albert does well is help you budget and keep an eye on your spending. It's a core feature that many people find incredibly useful, you see. You can easily monitor your bills and track your cash flow, which is pretty important for financial health.

The app shows you where every single dollar is going, which can be quite eye-opening. Knowing exactly where your money goes is the first step to making better financial choices, obviously. It provides a clear picture, which is good.

Albert looks at your income and how you spend your money. It then finds small amounts that it thinks you can comfortably put aside for savings, you know. This is a pretty smart feature, as it takes the guesswork out of saving, at the end of the day.

The app can even move your money automatically based on the settings you choose. This means you can set it up once and let Albert do some of the heavy lifting for you, which is very convenient. It's about making saving easier, in a way.

This automatic saving feature helps you build up your savings without you having to remember to do it every time. It’s a great way to stay consistent with your financial goals, you know. It truly helps automate good habits, pretty much.

It helps you stick to your financial plans without constant effort, which is a big plus for many people. This kind of automation can make a real difference in how much you save over time, so. It's pretty effective, honestly.

Smart Savings and Investing

Beyond just tracking, Albert also gives you ways to make your money grow. One popular option is opening a high-yield savings account through the app, you see. These accounts offer competitive rates on your deposits, which means your money earns more.

In fact, the rates offered can be over nine times the national average, which is a significant difference. Earning more on your savings helps your money work harder for you, which is pretty nice. It's a smart move for your future, you know.

Having a high-yield savings account within the app makes it easy to save and see your money grow over time. It's all part of the idea of having everything in one place, which is very convenient. This can really add up, you know.

Albert also touches on investing, providing options to help you get started with growing your wealth. This means you can explore ways to put your money into different opportunities, which is pretty exciting for some people. It's about building for tomorrow, basically.

Whether you're new to investing or have some experience, the app aims to make it approachable. It's about giving you the tools to potentially increase your financial well-being over time, you know. This can feel pretty empowering, actually.

The goal is to help you build a stronger financial future, little by little. Having savings and investment options together in one app simplifies the process quite a bit, so. It's all about making good money moves, pretty much.

Genius Advice and Support

Albert also offers a feature called Genius. This is where you can get personalized advice about your money, which is quite unique for an app, you see. If you have questions about your finances, you can ask Genius for help, at the end of the day.

People often wonder, "what can I ask Genius?" You can ask about a wide range of financial topics. This could be anything from understanding your spending habits to getting tips on how to save more effectively, you know. It's like having a financial helper ready to chat, pretty much.

This advice component adds a human touch to the app. It means you're not just looking at numbers; you're getting insights that can help you make better decisions, which is pretty valuable. It's about getting guidance when you need it, honestly.

They can help with common questions, like resetting your password or getting set up with the app. But they can also provide more in-depth advice on your financial situation, so. It's a pretty comprehensive support system, you know.

The Genius feature is there to support you on your financial path, providing guidance and answers. It's a way to feel more confident about your money choices, which is very important. It truly helps you feel more in control, basically.

Keeping Your Money Safe

Security is a big concern when it comes to money apps, and Albert takes this seriously. They have measures in place to protect your Albert account and your personal information, you see. This includes features for account security, which is pretty essential.

You can also manage your notifications, update your profile, and access your tax documents through the app. These features help you keep your account details current and secure, you know. It's about giving you control over your information, pretty much.

If you ever need to reset your password, the process is straightforward, ensuring you can always get back into your account. This ease of access, combined with strong security, gives users peace of mind, so. It's about making things simple and safe, honestly.

Albert also has an external overdraft reimbursement policy, which can be a real help for some users. This shows a commitment to supporting users through various financial situations, you know. It's a thoughtful feature, at the end of the day.

Knowing that your financial data is handled with care allows you to focus on managing your money, rather than worrying about security. This trust is a big part of why people choose to use Albert, you see. It's about feeling secure, basically.

How Albert Fits into Your Digital Life (Even on Snapchat)

In today's connected world, our phones are basically extensions of ourselves. We use them for everything from chatting with friends on Snapchat to checking the weather, you know. So, having a money management app like Albert right there on your mobile phone just makes sense, so.

While there isn't a direct "albert flamingo snapchat" integration in terms of a special filter or feature, the way people use apps like Albert fits perfectly with a mobile-first lifestyle. You can quickly check your budget or savings while waiting in line, or even during a short break, pretty much.

Imagine you're scrolling through Snapchat stories, and a thought about your budget pops into your head. With Albert, you can easily switch over, check your balances, or track a recent expense in just a few taps, you see. It's about quick access to your financial picture, at the end of the day.

People often share aspects of their lives on social media, and while financial details are private, the *concept* of being financially smart can be inspiring. You might see a friend sharing a tip about saving, and that could prompt you to check your Albert app, you know. It's about living a financially aware life, honestly.

The ease of downloading Albert from your app store means it's as accessible as any other popular mobile application. This makes it simple to add to your collection of daily-use apps, like Snapchat, which is very convenient. It truly becomes part of your routine, basically.

It's about having your financial tools where you live your digital life. This means you're more likely to actually use them and stay on top of your money, rather than putting it off, you see. It's about making good habits easy, pretty much.

So, even if "albert flamingo snapchat" is just a fun way someone searches, it points to a broader truth: people want their financial tools to be as easy to use and as integrated into their mobile world as their social apps. Albert aims to deliver on that convenience, you know. It's about seamless money management, in a way.

Starting Your Albert Adventure

Getting started with Albert is really straightforward. If you're ready to take control of your finances, the first step is to get the app on your phone, you know. You can download the Albert app directly from your mobile phone's app store, so.

Once the app is on your device, you just open it up to begin the registration process. It's designed to be simple and quick, which is pretty nice. You'll enter some basic information to create your account, you see.

To register, you'll need to provide your name and your email address. Then, you'll select a secure password to protect your account. Choosing a strong password is very important for your security, you know. It's a simple setup, honestly.

After these few steps, you'll be ready to start exploring all the features Albert has to offer. You can begin budgeting, tracking your spending, setting up savings goals, and even looking into investment options, at the end of the day. It's all there for you, pretty much.

Joining the millions of people who use Albert can truly change how you view and manage your money. It's about empowering you to make smarter financial choices every day, you know. It truly puts you in the driver's seat, basically.

So, if the idea of having a powerful app to help you with your money sounds good, consider giving Albert a try. It could be the tool that helps your finances really take off, like a flamingo, perhaps, you see. Learn more about Albert on our site, and check out this page for more financial tips.

Common Questions About Albert

People often have questions when they're thinking about using a new financial app. Here are a few common ones that might come up, you know, especially if you're searching for things like "albert flamingo snapchat."

Is the Albert app free to use?

Many people wonder if there's a cost involved with using Albert. The app offers various features, and while some core functionalities might be available without a fee, there can be premium services or subscriptions that unlock more advanced tools, you see. It's good to check the app store details for the most current information, so.

How does Albert help me save money automatically?

Albert has a clever way of helping you save. It looks at your income and your spending habits over time. Then, it finds small amounts of money that it believes you can comfortably set aside without missing them, you know. It can then move these amounts into your savings account automatically, based on your preferences, pretty much. It's a pretty neat system, honestly.

Can Albert help with overdrafts?

Yes, Albert does have a feature that can help with overdrafts. They have an external overdraft reimbursement policy, which is designed to provide some support in certain situations, you see. It's part of their commitment to helping users manage their money effectively and avoid common financial pitfalls, at the end of the day. This can be a real relief for some, you know.

Albert Einstein – Wikipedija

Albert Einstein Facts | Britannica

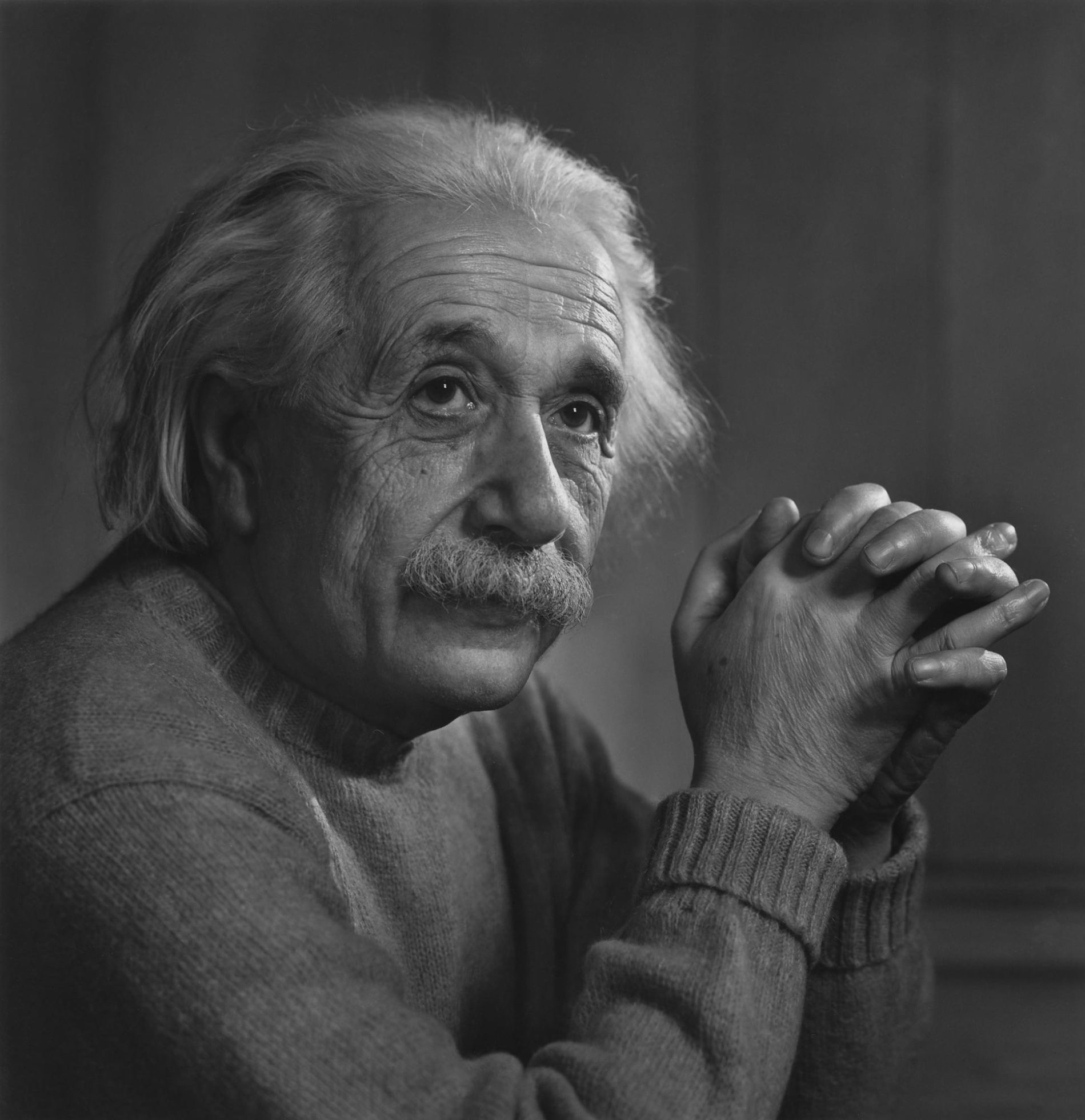

Albert Einstein – Yousuf Karsh