Understanding Currency Debasement: What It Means For Your Money Today

Have you ever felt like your money just doesn't go as far as it used to? That feeling of your hard-earned cash losing its buying power is, in some respects, a very real concern for many people right now. It brings us to a really important topic in the world of money: the debasement of the currency. This isn't just some old historical concept; it's something that can affect your daily life and your future savings, too it's almost.

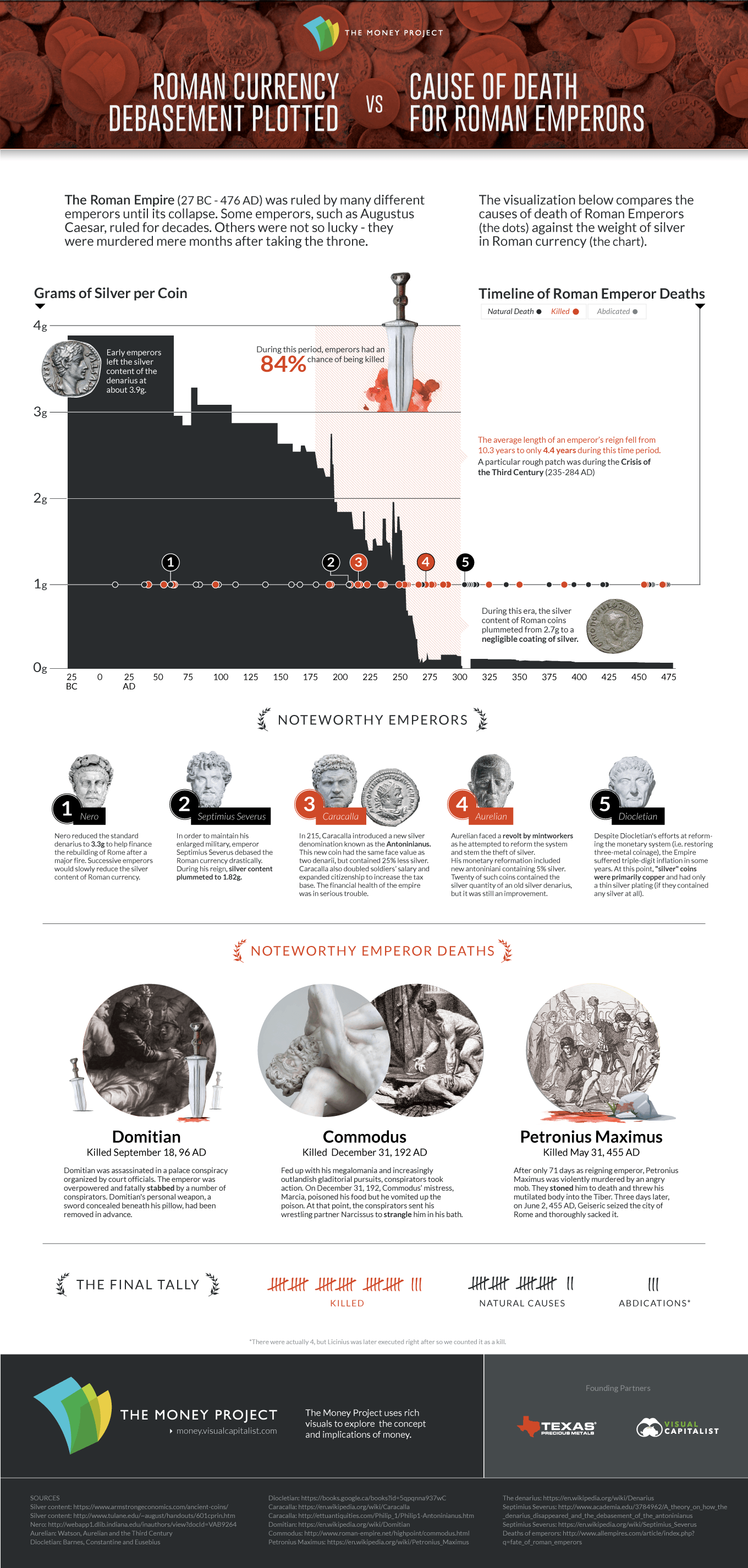

Historically, when we talk about debasement, it often came to be associated with commodity money, like coins made from precious metals. Think about it: a debasement of coinage was the practice of lowering the intrinsic value of those coins. This meant reducing the amount of gold or silver in them, making them worth less, even if they looked the same. It was, you know, a simple act of taking away from the worth or quality of the currency.

Today, the idea of debasement has grown a bit more complex, but the core meaning remains. It's still about a decline in a currency’s value, caused by reductions in its intrinsic worth or, very importantly, by excessive expansion of its supply. This phenomenon holds a pivotal role in understanding how currency value, inflation, and economic stability all connect. So, let's get into what debasement truly means for us all.

Table of Contents

- What Exactly is Debasement of the Currency?

- Why Do Governments Debase Their Currency?

- The Real-World Impact: What Happens to Your Money?

- Debasement vs. Inflation: A Closer Look

- Historical Echoes: Lessons from the Past

- Protecting Your Wealth in Times of Debasement

- Frequently Asked Questions About Currency Debasement

What Exactly is Debasement of the Currency?

When economists speak of debasement, they are referring to lowering the value of the money in an economy which is utilized to purchase goods and services. It's a financial term that holds a pretty big role in understanding the dynamics of currency value, inflation, and economic stability. Basically, it’s about making money less valuable.

Historical Roots: Commodity Money and Beyond

Think back to earlier times, and you'll find that debasing the currency refers to the all too common historical process of lowering a currency’s actual value. In the past, this phrase commonly came to be associated with commodity money. A debasement of coinage, for instance, was the practice of lowering the intrinsic value of coins, especially when used in connection with commodity money. This meant governments would intentionally reduce the precious metal content in a country’s coinage to diminish its value. It was, arguably, a straightforward way to get more coins out of less precious metal.

Modern Debasement: The Role of Central Banks

Fast forward to today, and things look a bit different. Our money isn't typically made of gold or silver anymore; it's what we call "fiat money." Yet, currency debasement is still a thing. It's a decline in a currency’s value caused by reductions in its intrinsic worth or, more commonly now, excessive expansion of its supply. The meaning of debased in banking often refers to the devaluation of currencies through the direct actions of central bankers. When central banks print more money, or expand the money supply significantly, that, in a way, dilutes the value of each existing unit of currency. It’s a structural dilution of a currency’s value, which is very different than just general price increases.

- Crete Carrier Corporation

- Charles Q Brown

- Kinetic Credit Union

- First Source Credit Union

- Porto Airport Arrivals Closure

Why Do Governments Debase Their Currency?

You might wonder why any government would want to make its own money worth less. Well, governments take conscious actions that lead to debasement, usually for what they see as immediate benefits, even if there are long-term drawbacks. There are both historical and contemporary examples of this happening, and the reasons tend to be similar, actually.

Funding Public Spending and Debt

One of the main reasons governments might go down this path is to fund their spending, especially when they have a lot of debt. When the federal debt grows, there can be an urgent need for monetary easing, which often means printing more money. This newly created money can then be used to pay off debts or fund government programs without having to raise taxes directly. It’s a way to, you know, sort of create money out of thin air to cover expenses. The inevitability of currency debasement and its implications from the growing federal debt is a topic many people are thinking about.

Boosting Exports (Temporarily)

Another reason might be to make a country's exports cheaper on the global market. When a currency is debased, it means it takes more of that currency to buy foreign goods and services, but it also means foreigners need less of their currency to buy goods and services from the debasing country. This can give a temporary boost to exports, making them more competitive. However, this is often a short-term gain with potential long-term issues, as a matter of fact.

The Real-World Impact: What Happens to Your Money?

So, what does all this mean for you, the everyday person? The effects of currency debasement are quite tangible and can hit your wallet directly. It’s not just abstract economics; it’s about your purchasing power and your trust in the financial system. When economists speak of debasement, they are referring to lowering the value of the money in an economy which is utilized to purchase goods and services.

Eroding Purchasing Power

The most immediate and noticeable impact of debasement is that it erodes purchasing power over time. This happens beyond what inflation numbers alone might reveal. If there’s more money floating around but the same amount of goods and services, each unit of money buys less. It’s like having a bigger slice of a shrinking pie. That dollar purchasing power chart, you know, really shows how the dollar’s value decreases as the Fed continues to print money and inflate the money supply. This is a very real concern for many people, especially those on fixed incomes.

Fueling Inflation

While debasement is different from inflation, it very often leads to it. When the supply of money increases significantly without a corresponding increase in goods and services, prices for everything tend to go up. This means that your money buys less, and you need more of it to afford the same things you did before. It’s a classic case of too much money chasing too few goods, and it can really make things feel more expensive.

Trust and International Standing

Additionally, debasement can have negative consequences for a country's international reputation and credibility. If a country is seen as regularly debasing its currency, it can become harder to attract foreign investments. Other countries and investors might lose trust in that currency’s stability, making them less willing to hold it or invest in that economy. This can, you know, lead to a loss of confidence on the global stage, which is a big deal.

Debasement vs. Inflation: A Closer Look

It's important to understand that while debasement and inflation are related, they are not quite the same thing. Many people confuse the two, but there's a key difference. Learn the difference between inflation and debasement, how they affect things, and you'll get a clearer picture. While both reduce purchasing power, they do it in slightly different ways.

Inflation is generally understood as a broad increase in the prices of goods and services across an economy. It means your money buys less because things cost more. This can happen for various reasons, like increased demand or supply chain issues. Debasement, conversely, implies a structural dilution of a currency’s value. This is vastly different than inflation in its root cause. In a "debasement" scenario, governments take conscious actions, often related to the money supply itself, to lower the currency's value. It’s about the money itself losing its inherent worth, rather than just prices going up due to market forces. The "debasement" argument is at best premature, and at worst, deeply misleading if you don't grasp this distinction.

Historical Echoes: Lessons from the Past

History is full of stories about currency debasement. From ancient Rome reducing the silver content in its denarius to various nations in the 20th century printing vast amounts of money, the pattern is pretty consistent. These historical examples teach us a lot about the economic impact of such actions, and how they affect inflation, purchasing power, and trust in money. For instance, the Roman Empire faced serious economic troubles partly because its emperors kept debasing their coinage to pay for wars and other expenses. Eventually, people lost faith in the currency, leading to widespread economic instability. You know, it's a cautionary tale, really.

More recently, some countries have experienced hyperinflation, a very extreme form of currency debasement, where money becomes almost worthless. These cases highlight how quickly trust can erode and how devastating the impact can be on ordinary citizens. Explore how dollar debasement affects economic stability and global markets, and discover strategies to mitigate its impact, because these lessons are still relevant today, apparently.

Protecting Your Wealth in Times of Debasement

Given that currency debasement is a phenomenon where a country's money loses value, what can individuals do to protect their financial well-being? It's a fair question, and there are some general approaches people consider. One common strategy is to hold assets that tend to retain their value or even increase during periods of currency weakening. This might include physical assets like real estate or precious metals, or even certain types of stocks that represent ownership in productive businesses. Some people look at commodities, too, as a way to preserve purchasing power, since they are tangible goods rather than paper money.

Another approach involves diversifying your investments across different asset classes and even different currencies, if that makes sense for your situation. Learning about currency debasement, its causes, historical examples, and economic impact can help you make more informed decisions about your own money. It's about being aware of the dynamics at play and making choices that align with your long-term financial goals. For more detailed insights into global economic trends, you might want to check out a trusted financial resource, like a major financial news outlet, to stay informed on these big picture movements. Learn more about on our site, and link to this page for additional resources.

Frequently Asked Questions About Currency Debasement

What is the difference between debasement and inflation?

While both reduce your money's buying power, debasement specifically refers to a deliberate act by a government or central bank to lower the intrinsic value of its currency, often by increasing the money supply. Inflation, on the other hand, is a general rise in prices across the economy, which can be caused by many factors, including debasement, but also things like strong demand or supply shortages. Debasement is, you know, a cause, while inflation is often a symptom.

How does debasement affect my money?

When currency is debased, your money loses its purchasing power. This means that over time, the same amount of money will buy you fewer goods and services. It's like your savings slowly shrinking in value, even if the number on your bank statement stays the same. This can affect everything from the cost of groceries to the value of your retirement funds, quite significantly.

Are there historical examples of currency debasement?

Absolutely, history is full of them! From the Roman Empire reducing the precious metal content in its coins to various countries in the 20th century printing large amounts of paper money to fund wars or pay debts, there are many instances. These historical cases, you know, really show how debasement has been a recurring theme throughout economic history, and the outcomes tend to be similar across different eras.

Currency Debasement Quotes. QuotesGram

Currency Debasement Quotes. QuotesGram

Roman currency debasement • History Infographics