Your Guide To The Ms Department Of Revenue: Making Taxes Simpler

Understanding how state agencies work can feel like a big task, but when it comes to the ms department of revenue, knowing what they do truly helps everyone in Mississippi. This agency, you see, is the main spot for gathering tax money. That money then goes to help out both state and local governments across Mississippi, supporting services and projects that benefit us all. So, in a way, what they do helps keep things running smoothly for communities everywhere in the state, from the biggest cities to the smallest towns. It’s all about supporting the public good, actually.

The ms department of revenue plays a pretty important role in the state's daily operations. They are the key agency for collecting all sorts of tax revenues. This work directly supports the various functions of state and local governments throughout Mississippi. It’s a system designed to help fund everything from schools and roads to public safety and other essential services. You know, it really makes a difference.

This article will walk you through what the ms department of revenue offers, especially focusing on how their online services can make your life a bit easier. We'll look at ways to pay taxes, apply for titles, and even find out about business permits. It’s about getting the information you need, you know, right at your fingertips.

- Eden Prairie Weather

- Phil Collins Tour

- Josh Smith Corey Brewer Game

- Razorback Baseball Today

- 15 Dollar Bill

Table of Contents

- What is the ms department of revenue?

- Online Services for You: Making Things Easier

- Business Licenses and Permits: Getting Started

- Speeding Up Your Refund: Electronic Filing

- The ms department of revenue in Action: Community and Collaboration

- Important Website Information: Cookies and Access

- Frequently Asked Questions

- Connecting with the ms department of revenue

What is the ms department of revenue?

The ms department of revenue is, to put it simply, the main group responsible for collecting tax money in Mississippi. This money is absolutely vital because it helps fund state and local governments. Think about it, every service provided by the state, every public project, pretty much relies on these funds. So, in a way, they are the financial backbone for public services across Mississippi. They ensure the state has the means to operate, you know, and serve its people.

Their work involves a lot more than just collecting money. They also make sure the tax system works fairly and efficiently for everyone. This includes providing information, offering ways to pay, and generally helping people understand their tax duties. It's a big job, very big, and it impacts pretty much every resident and business in Mississippi.

The department also works to keep up with current practices, like representing Mississippi at events such as the Southeastern Association of Tax Administrators (SEATA) conference. Mississippi has been a member of this group for some time, which suggests a commitment to working with other states on tax matters. This collaboration, in some respects, helps improve how things are done across the region.

- Al Riyadh Vs Al Nassr

- Flier Or Flyer

- Weather Buffalo Grove Il

- Weather Atlantic City Nj

- David Wasserman X

Online Services for You: Making Things Easier

The ms department of revenue has put a lot of effort into making things simpler through their website. This site offers information about various aspects of their work, which is pretty helpful. It’s designed to be a central spot for people looking to understand their tax obligations or use specific services. You know, it's about convenience.

For many people, the ability to handle tasks online is a real time-saver. The department understands this, and that’s why they’ve set up different ways for people to interact with them without needing to visit an office. This makes it easier to manage your tax duties from home or your workplace, which is a big plus for a lot of folks.

QuickPay for Taxes

One of the really helpful features on the ms department of revenue website is the online Mississippi Tax QuickPay service. This tool is for both businesses and individuals, so it covers a lot of ground. It allows you to quickly and securely pay your Mississippi taxes, which is a pretty big deal for many people. You can use a credit card or a debit card, offering flexibility in how you make your payments.

The idea behind QuickPay is to offer a simple, straightforward way to handle your tax payments. Nobody really enjoys paying taxes, but having a secure and fast method can certainly make the process less of a headache. It means you can get your payment done without a lot of fuss, which is that, a very good thing for busy people.

This service is designed with security in mind, giving you peace of mind when you submit your payment information. It’s about making the process as smooth and worry-free as possible. You know, it’s about trusting the system.

Electronic Title Applications

Beyond tax payments, the ms department of revenue also supports electronic submission of title applications. This is another example of how they are working to streamline processes for citizens. Submitting these applications electronically can save you time and paper, which is a win-win for everyone involved. It simplifies a process that might otherwise require physical paperwork and trips to an office.

The shift to electronic methods for things like title applications shows a commitment to modernizing how government services are delivered. It means less waiting and more convenience for you, the person needing the service. This kind of efficiency is something people often appreciate, you know, in this day and age.

This digital option allows you to handle an important task from wherever you are, as long as you have internet access. It takes away some of the hassle that can come with traditional paperwork. So, it's just a little bit easier for you.

Business Licenses and Permits: Getting Started

For anyone thinking about starting a business or already running one in Mississippi, knowing about licenses and permits is very important. The ms department of revenue, or at least its associated resources, can point you in the right direction. The Mississippi state code, for example, along with tools like SBA.gov's business licenses and permits search, helps you figure out what you need. This tool, you know, lets you get a listing of federal, state, and local permits, licenses, and registrations.

Finding all the correct licenses and permits can seem like a puzzle, but resources are available to help simplify it. The goal is to ensure businesses can operate legally and successfully within the state. It’s about providing the necessary guidance so you can comply with all the rules. This helps businesses avoid problems down the road, which is pretty good.

Understanding these requirements from the start can save a lot of trouble later on. It’s part of building a solid foundation for any business venture in Mississippi. So, basically, it helps you get things right from the beginning. Learn more about business requirements on our site, and link to this page for more details on specific state regulations.

You can find out more about what might be needed for your business by checking out the SBA.gov business licenses and permits search tool. This tool is a helpful place to begin your research into what your business might need to operate legally in Mississippi. It's a good first step, you know, for anyone starting out.

Speeding Up Your Refund: Electronic Filing

For those expecting a tax refund, getting your money back quickly is often a priority. The ms department of revenue suggests that electronic filing of your tax return, combined with choosing direct deposit, can significantly speed up your refund. In fact, it might speed up your refund by as much as eight weeks! That’s a pretty considerable difference for many people.

This advice highlights the benefits of using digital methods for tax interactions. Electronic filing reduces the time it takes for your return to be processed, and direct deposit means the money goes straight into your bank account without delays from mailing checks. It’s about efficiency, you know, for your money.

If you are someone who likes to get things done quickly, then this is definitely something to consider. It’s a simple step that can make a big difference in how fast you receive your money. So, it's almost a no-brainer if you want your refund sooner.

The ms department of revenue in Action: Community and Collaboration

The ms department of revenue doesn't just work behind the scenes; they also participate in broader efforts related to tax administration. For instance, they were proud to represent Mississippi at the Southeastern Association of Tax Administrators (SEATA) conference this week. Mississippi has been a member of this association, which suggests a commitment to working with other states.

Being part of groups like SEATA allows the department to share knowledge and learn from other states' experiences in tax collection and administration. This kind of collaboration can lead to better practices and more efficient systems for everyone involved. It’s about continuous improvement, you know, for the whole region.

Their participation shows a dedication to staying current with best practices in the tax world. It means they are actively involved in discussions that shape how tax systems work across the Southeast. So, they are pretty much on top of things.

Important Website Information: Cookies and Access

When you visit the ms department of revenue website, there's one technical detail that’s quite important to remember: cookies. The site clearly states that your browser appears to have cookies disabled, and that cookies are required to use the site. This means that for the website to function properly and for you to access its services, your browser needs to allow cookies.

Cookies are small pieces of data that websites store on your computer. They are pretty common and often help a site remember your preferences or keep you logged in. For a site that handles sensitive information like tax payments, they are often used for security and session management. So, it's just a little thing that helps the site work.

If you find you can't access parts of the ms department of revenue website, checking your browser's cookie settings would be a good first step. Enabling cookies for the site will allow you to use all the features, including the QuickPay service and other online tools. It's a small technical adjustment that makes a big difference in how you interact with the site, you know, for smooth operation.

Frequently Asked Questions

What is the primary role of the Mississippi Department of Revenue?

The ms department of revenue is the main agency in Mississippi responsible for collecting tax revenues. These collected funds directly support both state and local governments, helping to pay for public services and projects across the state. It’s about making sure Mississippi has the money it needs to operate, you know, for everyone's benefit.

How can individuals and businesses pay their Mississippi taxes online?

Individuals and businesses can use the online Mississippi Tax QuickPay service provided by the ms department of revenue. This service allows you to securely pay your Mississippi taxes using a credit card or a debit card. It’s a convenient way to handle your tax obligations without needing to send a check or visit an office, so it's very helpful for many.

Where can I find information about business licenses and permits in Mississippi?

The ms department of revenue website provides information about various requirements, and you can also use resources like the SBA.gov's business licenses and permits search tool. This tool helps you get a listing of federal, state, and local permits, licenses, and registrations you might need for your business in Mississippi. It’s a good starting point, you know, for getting organized.

Connecting with the ms department of revenue

The ms department of revenue truly plays a central part in Mississippi’s financial health and the services provided to its citizens. From making tax payments easier with QuickPay to speeding up refunds through electronic filing, their efforts aim to simplify interactions for everyone. They work to support state and local governments, making sure vital services get the funding they need.

Using the online tools they offer can save you time and make managing your tax duties a lot less complicated. Remember to keep your browser cookies enabled for the best experience on their website. It’s all about making your interactions with state tax matters as straightforward as possible, you know, for your convenience.

- Weather Greensburg Pa

- Liberty First Credit Union

- Razorback Football 247

- Mission West Elementary

- Weather Of Virginia Beach

Multiple sclerosis in primary care – diagnosis and early treatment

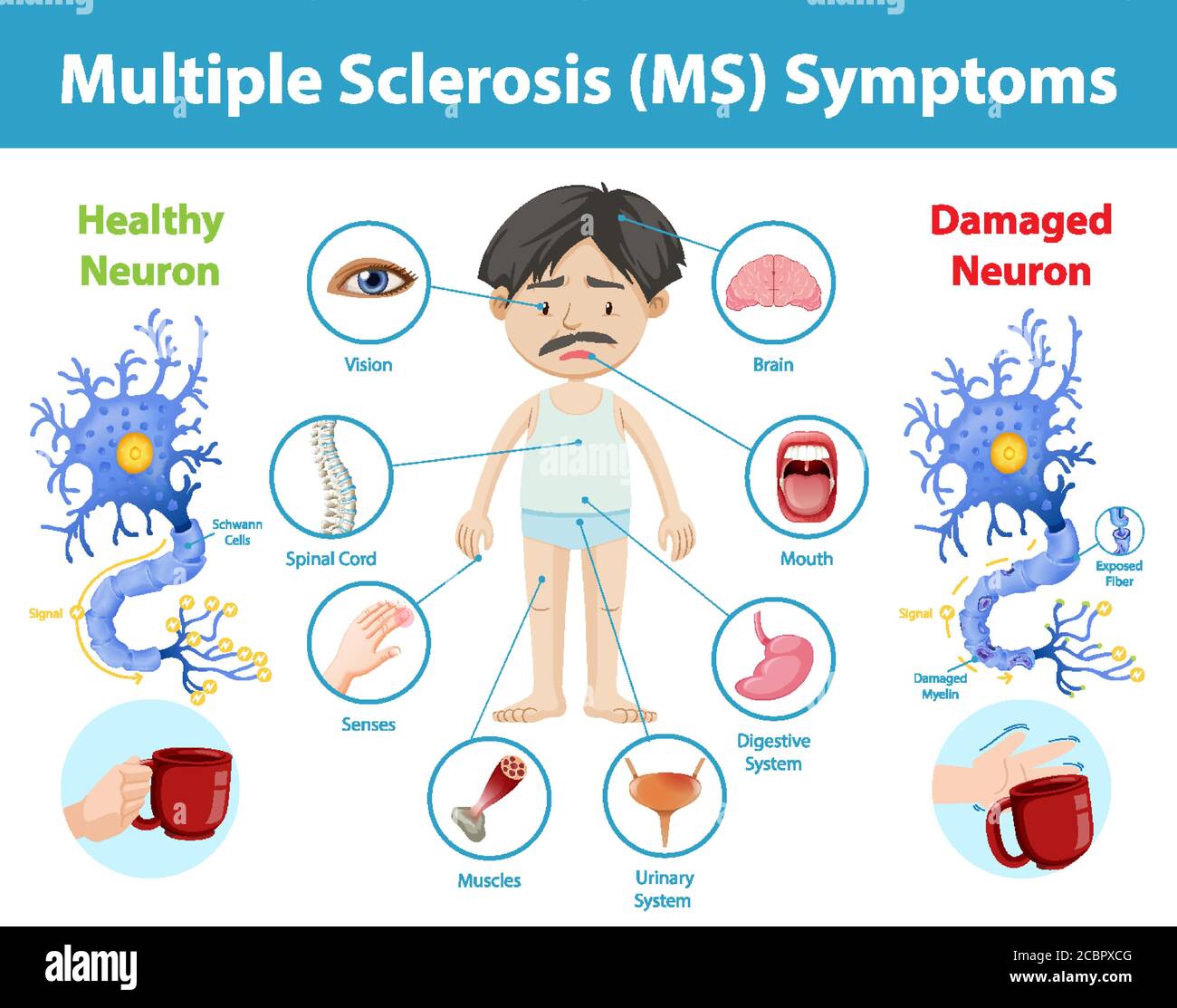

Multiple sclerosis (MS) symptoms information infographic illustration

What is Multiple Sclerosis (MS) - MS Australia