Understanding The Randy Rosenberg Statement And Your Financial Future

Many folks are talking about the recent randy rosenberg statement, and it seems to be sparking quite a bit of thought about money matters. This particular statement, which has gained attention recently, points to some interesting shifts in how we might think about our savings. It makes sense, really, to consider what a respected voice in finance has to say about the economy's direction, especially when it touches on personal wealth. So, it's almost like a nudge for many to look closely at their financial plans.

When someone like Randy Rosenberg shares their insights, people often pay attention, and that's for good reason. Their words can give us a fresh perspective on market movements or potential challenges ahead. This particular statement, you know, seems to highlight the importance of being prepared for different economic conditions. It’s about more than just numbers; it’s about peace of mind for your financial journey.

For many, this discussion around the randy rosenberg statement brings up questions about safeguarding what they've worked hard to build. It prompts a closer look at investment choices, especially those meant for the long haul. Thinking of converting your IRA to gold, for example, becomes a topic of interest for some. It's a way people consider protecting their retirement funds in uncertain times, a consideration that seems to resonate with the broader message of the statement.

- Esha Mae Porn

- Weather Of Virginia Beach

- United States National Cricket Team Vs Ireland Cricket Team Timeline

- Kentucky State Football

- I 80 Iowa Road Closure

Table of Contents

- Randy Rosenberg: A Brief Look

- The Essence of the Randy Rosenberg Statement

- Why the Statement Matters for Your Investments

- Considering a Gold IRA Rollover

- How to Start Your Gold IRA Journey

- Common Questions About the Randy Rosenberg Statement

- Moving Forward with Your Retirement Planning

Randy Rosenberg: A Brief Look

While the focus here is on the randy rosenberg statement itself, it's useful to know a little about the person behind the words. Randy Rosenberg is recognized in financial circles for his insights and observations. He often shares perspectives on market trends and economic shifts. This background gives weight to his public comments, helping people consider them seriously.

Personal Details and Bio Data

| Detail | Information |

|---|---|

| Known For | Financial insights, market commentary |

| Area of Focus | Economic trends, investment strategies |

| Influence | Shapes discussions on financial preparedness |

| Role | Thought leader in finance |

The Essence of the Randy Rosenberg Statement

The core message of the randy rosenberg statement, in some respects, seems to center on financial prudence in an unpredictable world. It suggests that individuals should look beyond traditional investment paths. The statement, apparently, hints at the importance of protecting wealth from inflation or market swings. It's a call, you know, for a more thoughtful approach to long-term savings.

This statement, which many are discussing, does not give specific investment advice. Instead, it seems to offer a broader perspective on current economic conditions. It asks people to think about how their money might fare during different times. This kind of general guidance, actually, can be very helpful for those planning for retirement.

For example, the statement might touch upon the rising cost of living or changes in global markets. These are things that directly affect our purchasing power and savings. It's about being aware, really, of the bigger picture. The randy rosenberg statement encourages a proactive stance, which is a good thing for anyone managing their money.

Why the Statement Matters for Your Investments

The implications of the randy rosenberg statement for your investments are quite significant. When a respected financial voice speaks about market stability or future economic outlooks, it often prompts investors to review their portfolios. This statement, you know, could make you consider if your current investments align with your long-term goals. It's a moment to pause and reflect on where your money sits.

For many, the statement brings up the idea of diversification. Spreading your investments across different asset types can help reduce risk. This is a basic principle of smart money management. The randy rosenberg statement, in a way, reinforces this idea, suggesting that having all your eggs in one basket might not be the best plan right now. It pushes people to think broadly about their holdings.

This discussion also touches on the concept of safe-haven assets. These are investments that tend to hold their value, or even increase, during times of economic trouble. Gold, for instance, is often seen as a safe haven. The statement, perhaps, makes people think more about including such assets in their plans. It's about building a more resilient financial future, which is very important for peace of mind.

Considering a Gold IRA Rollover

Given the discussions around the randy rosenberg statement, many people are looking into ways to protect their retirement funds. One option that often comes up is converting a traditional IRA or 401(k) to a Gold IRA. Before you decide to invest, learn how the entire process works in this guide. It's a move that some consider for adding a layer of security to their savings, especially in times of economic uncertainty.

Discover the benefits and process of transferring your retirement funds. This isn't a decision to take lightly, of course. It involves moving a significant portion of your future security. Understanding each step helps make the process smooth. It’s about making an informed choice for your financial well-being, which is pretty much what the statement encourages.

Learn how you can transfer a portion of your IRA to gold. Rolling your funds over into a gold IRA is a fairly straightforward process, actually. It does involve specific steps, but it's not overly complicated. Many find this option appealing as a way to diversify their retirement portfolio. It's a concrete action that aligns with the broader message of financial preparedness.

What is a Gold IRA?

A Gold IRA is a special type of individual retirement account. It allows you to hold physical gold, or other approved precious metals, as part of your retirement savings. Unlike a regular IRA that holds stocks, bonds, or mutual funds, a Gold IRA holds actual gold bullion or coins. This is a key difference, you know, for those seeking tangible assets.

The gold is not kept at your home. Instead, it is stored in an approved depository. These depositories are secure, regulated facilities. This ensures the safety and integrity of your investment. It's a way to own physical gold without the worries of personal storage. This structure, you know, provides peace of mind for many investors.

The rules for a Gold IRA are set by the IRS. There are specific types of gold and other precious metals that qualify. It's important to work with a custodian who specializes in these accounts. They can guide you through the regulations. This ensures your investment meets all legal requirements, which is very important for your financial future.

The Process of Transferring Funds

Transferring your retirement funds into a Gold IRA involves a few key steps. First, you choose a Gold IRA custodian. This custodian manages your account and handles the purchase and storage of your gold. They are a vital part of the process. Finding a reputable one is the first big step, so, that's really important.

Next, you initiate a rollover or transfer from your existing IRA or 401(k). This can be a direct rollover, where funds move straight from one custodian to another. Or, it can be an indirect rollover, where you receive the funds first and then deposit them into the new Gold IRA within 60 days. The direct method, by the way, is often simpler and avoids tax issues.

Once the funds are with your Gold IRA custodian, you direct them to purchase approved precious metals. They will then arrange for the secure storage of your gold at an approved depository. Here's how to do it. The entire process is designed to be as smooth as possible, allowing you to move your assets with confidence. It's a straightforward way to diversify your retirement savings.

Benefits of a Gold IRA

One primary benefit of a Gold IRA is its potential as a hedge against inflation. When the cost of living goes up, the value of paper money can go down. Gold, however, tends to hold its value or even increase during these times. This makes it an attractive option for preserving purchasing power. It's a way to protect your nest egg, you know, from economic pressures.

Another benefit is diversification. Adding gold to your retirement portfolio can help reduce overall risk. Gold's price movements often differ from those of stocks and bonds. This means that when other investments might be struggling, gold could be performing well. It helps balance your portfolio, which is a good thing for long-term stability.

Gold is also seen as a safe haven during economic or geopolitical uncertainty. In times of crisis, investors often flock to gold as a reliable asset. This demand can drive its price up. It provides a sense of security when other markets are volatile. This makes it a compelling choice for those looking to protect their wealth. That, is that, a very real benefit for many.

How to Start Your Gold IRA Journey

Starting your Gold IRA journey begins with research. Look for reputable Gold IRA companies and custodians. Check their reviews and track record. It’s important to choose a partner you trust with your retirement funds. This initial step, actually, sets the foundation for your entire investment.

Next, you'll need to open a new self-directed IRA account with your chosen custodian. They will help you with the paperwork. This account is specifically designed to hold precious metals. It's a distinct type of retirement account, so, it has its own rules and features.

Then, you can initiate the transfer or rollover of funds from your existing retirement account. Your Gold IRA custodian will guide you through this process. They will ensure it complies with all IRS regulations. Once your funds are in the new account, you can select the gold or other precious metals you wish to purchase. Login to the Outlier account dashboard to access the current portfolio holdings, closed trade records, and adjust your account settings. This allows you to truly manage your investment. It’s a straightforward path to diversifying your retirement.

Common Questions About the Randy Rosenberg Statement

Many people have questions about the randy rosenberg statement and its broader implications. Here are some common inquiries:

What is the significance of Randy Rosenberg's statement?

The significance of the randy rosenberg statement lies in its timing and general message. It often comes at a moment when economic conditions are shifting. The statement encourages people to think about financial preparedness. It highlights the need for careful planning in an uncertain economic climate. This kind of message, you know, can prompt many to review their investment strategies.

How does Randy Rosenberg's statement relate to current financial trends?

The randy rosenberg statement typically relates to current financial trends by addressing broad economic concerns. It might touch on inflation, market volatility, or interest rates. The statement often suggests a need for diversification or alternative assets. It encourages a proactive approach to managing wealth in today's market. This connection makes it relevant for anyone watching the economy.

Where can I find more details about Randy Rosenberg's financial insights?

For more details on Randy Rosenberg's financial insights, you might look at reputable financial news outlets. These sources often cover his public comments or interviews. You could also check official publications or reports he may contribute to. A good starting point, for instance, might be a well-known financial news site like Reuters Gold News. Always seek information from credible sources for financial matters.

Moving Forward with Your Retirement Planning

The discussions sparked by the randy rosenberg statement really emphasize the importance of active retirement planning. It's not enough to just set money aside; you need to think about how that money is protected and grows. This means regularly reviewing your portfolio and making adjustments as needed. It's a continuous process, actually, that evolves with your life.

Considering options like a Gold IRA rollover can be a smart move for some. It offers a way to diversify and potentially safeguard your savings from economic downturns. Discover the benefits and process of transferring your retirement funds. Before you decide to invest, learn how the entire process works in this guide. This knowledge empowers you to make choices that truly fit your financial goals. It's about taking control of your future, which is very important.

Ultimately, the goal is to build a retirement fund that offers security and growth potential. Whether it's through traditional investments or by including precious metals, the key is informed decision-making. Start earning from home today! We'll send you a code you can use to log in enter your email continue with email or. Outlier USA get Outlier USA | © 2025 all rights reserved. This kind of proactive approach, you know, can make a significant difference in your financial well-being. It's about planning wisely for the years ahead.

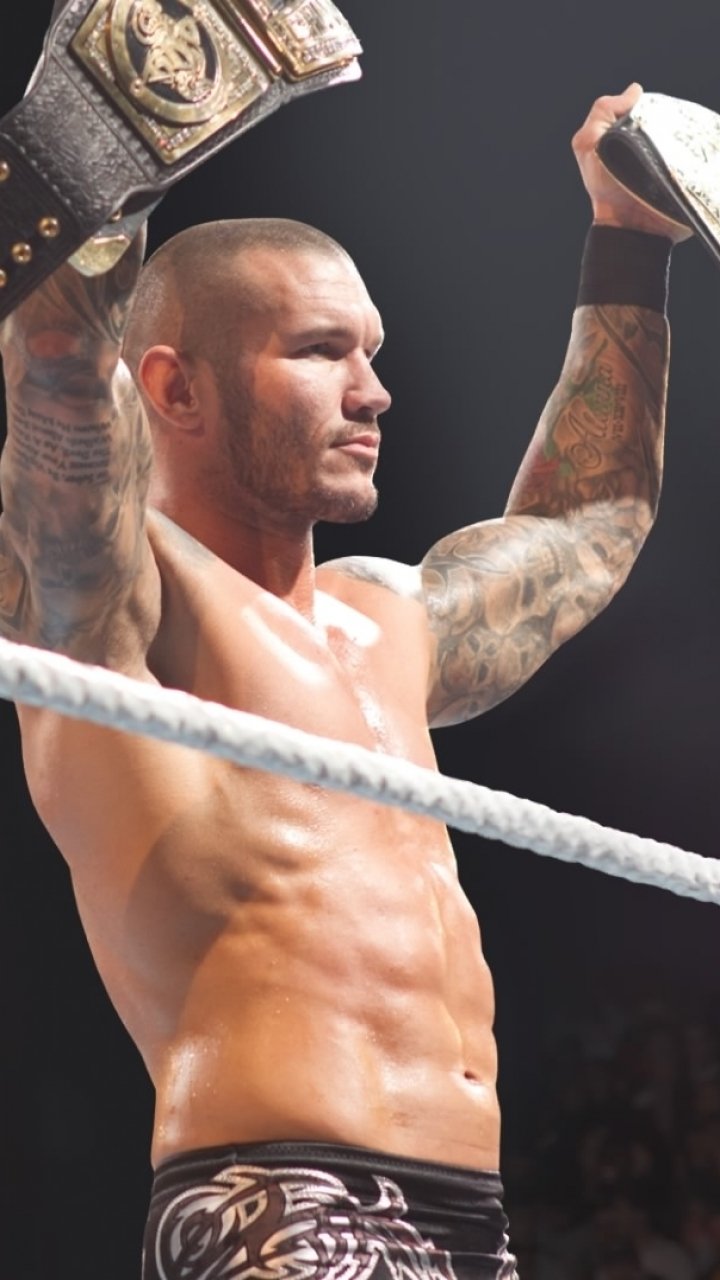

Randy Orton Wallpaper

Wwe Randy Orton Wallpaper 2015 - WallpaperSafari

Randy Orton Phone Wallpapers