Your Capital One Debit Card: A Handy Tool For Everyday Money

A Capital One debit card is a pretty useful item to have in your pocket, honestly. It's a straightforward way to handle your money, letting you buy things, get cash, and keep an eye on what you're spending with very little fuss. This little piece of plastic, or even its digital twin, gives you a lot of freedom when it comes to your finances, helping you stay on top of things without much bother. It's quite a helpful companion for your daily spending, whether you're grabbing coffee or paying for something bigger, so it's almost a must-have for many people today.

Having a Capital One debit card, especially if it's linked to a 360 Checking account, can make managing your funds quite simple. You get a free debit card when you open one of these accounts, which comes with no monthly fees, no minimum balance requirements, and, importantly, no overdraft fees for many transactions. This setup is really designed to give you peace of mind, allowing you to focus on your purchases rather than worrying about hidden charges or unexpected costs, which is pretty nice.

This card isn't just for spending, though; it's a key to accessing your money in various ways. You can use it at over 70,000 ATMs, make digital payments with Zelle®, and it generally works at millions of places across the United States. It's a very accepted form of payment, meaning you'll likely find it useful almost anywhere you go, whether you're shopping in person or online, which is quite convenient, you know?

- Beth Stone Nude

- Porto Airport Arrivals Closure

- Farmington Municipal Schools

- Kamen America Alpha The Manga

- City Of Edmond

Table of Contents

- What is a Capital One Debit Card?

- Getting Your Capital One Debit Card

- Making Your Card Ready: Activation and Linking

- Using Your Capital One Debit Card Daily

- Understanding Debit Card Acceptance and Fees

- When You Need a New Card

- Extra Perks and Protections

- Frequently Asked Questions (FAQs)

- Wrapping Things Up

What is a Capital One Debit Card?

A Capital One debit card acts like a direct link to your checking account. It lets you use your own money for purchases and cash withdrawals, rather than borrowing funds like you would with a credit card. This makes it a really good way to keep track of your spending, since you're using money you already have, which can be quite reassuring, you know?

Why It Matters for You

For many people, this card is a central piece of their financial picture. It helps you make purchases, get cash when you need it, and see where your money is going quite easily. Whether you're paying for groceries or a larger item, it offers a simple way to manage your daily expenses, providing a sense of control over your funds, which is pretty important for a lot of us.

The Mastercard Connection

Many Capital One debit cards come with Mastercard branding, which means they're widely accepted. This connection means you can swipe, insert, or tap your card at millions of places that take Mastercard, making it a very convenient payment method almost anywhere you go. This broad acceptance is a big plus, as it means fewer worries about whether your card will work when you need it, which is actually a significant benefit.

Getting Your Capital One Debit Card

Getting your hands on a Capital One debit card usually starts with opening a checking account. The 360 Checking account is a popular choice for many, offering quite a few appealing features that make it stand out. It's designed to be user-friendly and cost-effective, which is what many people look for in a bank account these days.

Opening a 360 Checking Account

You can open a Capital One 360 Checking account either online or by visiting a branch, which offers flexibility depending on what works best for you. These accounts come with no fees, no minimum balance requirements, and no overdraft fees, which is a pretty good deal for everyday banking. When you open one, you'll get a free debit card, plus access to a huge network of ATMs and digital payment options like Zelle®, so that's quite a package.

Cards for Younger Users

Capital One also has options for younger people, specifically debit cards available for kids aged eight and up. These cards come with no monthly service or subscription fees and no minimum balance requirements to open, which is a great way to help younger individuals learn about managing money early on. It's a way to introduce financial responsibility in a controlled environment, which parents might find very helpful, you know?

Making Your Card Ready: Activation and Linking

Once your new Capital One debit card arrives, it's important to make it active before you start using it. This is a quick process that ensures your card is secure and ready for your transactions. It's a simple step, but a very necessary one, apparently.

How to Activate Your New Card

You can activate your new debit card online or by phone in just a few minutes, which is quite convenient. During this process, you may need to set a Personal Identification Number (PIN) to complete the activation. This PIN is really important for secure ATM withdrawals and some purchases, so make sure it's something you'll remember but isn't too easy for others to guess, which is just good practice.

Connecting to Your Accounts

Your debit card is meant to connect directly to your checking account, allowing you to access your funds easily. You can also learn how to switch the spending account linked to your debit card online or by phone. This means you can, in some respects, link your card to a different checking or savings account if you need to, giving you flexibility over where your money comes from for purchases, which is quite useful.

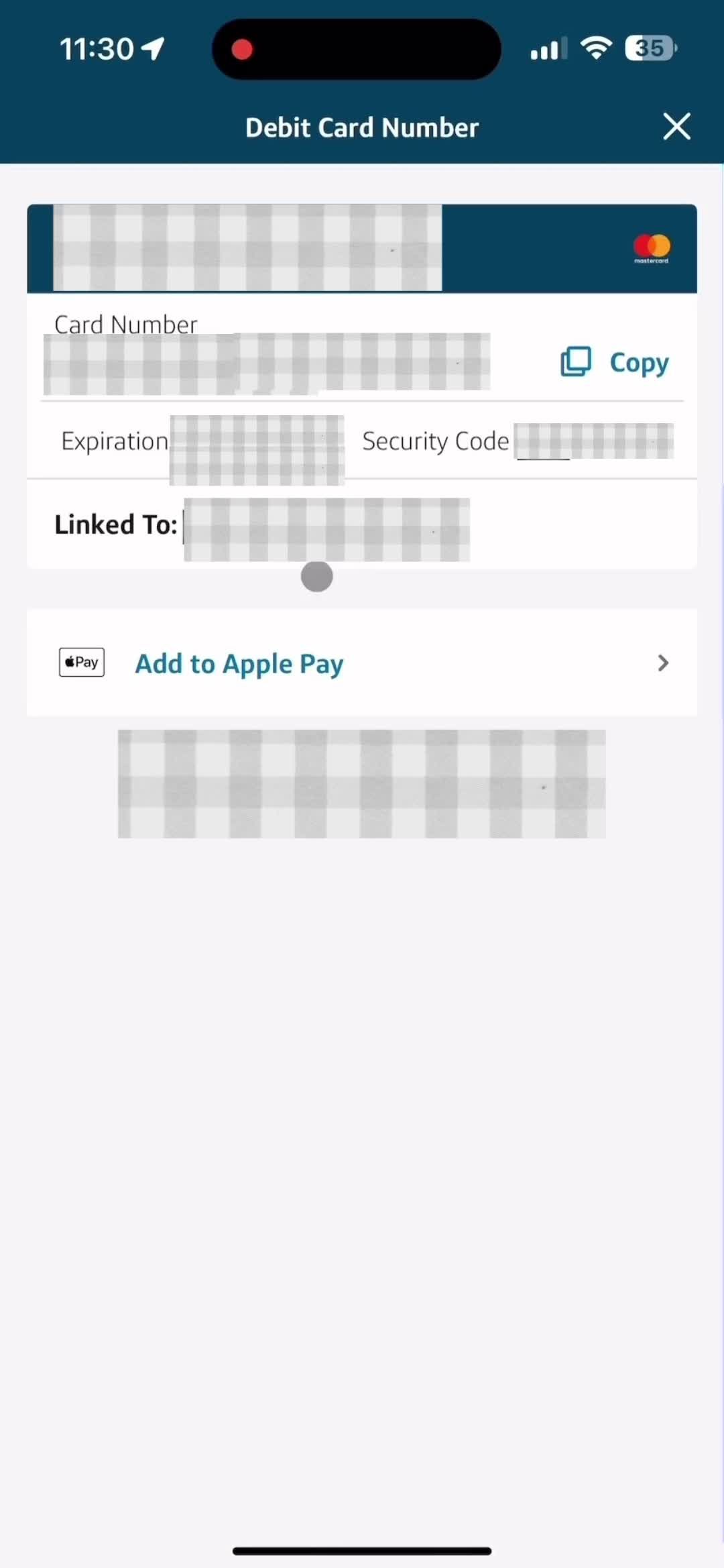

Adding to Your Digital Wallet

Many people wonder if they can add their Capital One debit card to their digital wallet, and the answer is yes! This allows you to make payments with your phone or other devices, adding another layer of convenience and security to your transactions. It's a modern way to pay that many find very handy, especially when they don't want to carry their physical card, which is pretty common these days.

Using Your Capital One Debit Card Daily

Using your Capital One debit card for everyday activities is pretty straightforward. It's built for convenience, whether you're making a small purchase or getting cash. This card is truly a tool for regular money movement, so it's quite versatile.

Everyday Purchases and Cash Access

With your Capital One debit card, you can easily make everyday purchases by simply swiping, inserting, or tapping your card. It's also your key to withdrawing cash from your 360 Checking account at any Capital One ATM, which requires an activated debit card for access. This means your funds are always within reach, which is a good feeling, honestly.

Managing Your Money on the Go

You can sign in to your Capital One accounts online to view your balances, pay bills, transfer money, and do much more. This digital access means you can manage your finances from almost anywhere, keeping you informed and in control of your money. It's a bit like having a bank branch in your pocket, which is incredibly convenient, you know?

ATM Withdrawal Limits

It's good to know about the limits for cash withdrawals. For example, the Capital One 360 Checking account has a daily ATM withdrawal limit of $5,000 when you use your debit card. If you're using the mobile app for a withdrawal, the limit is $200. These limits are set to help protect your account, but it's worth keeping them in mind if you need a large amount of cash, which is something to consider.

Understanding Debit Card Acceptance and Fees

While Capital One debit cards are widely accepted, there are a few situations where you might encounter issues or extra costs. Knowing about these can help you avoid surprises, which is always a good thing, you know?

When Your Card Might Be Declined

Sometimes, users share experiences of their Capital One debit card being declined or not accepted, especially at certain restaurants or online. This can happen for various reasons, like insufficient funds, a security flag, or an issue with the merchant's system. If this happens, it's usually best to check your account balance or contact Capital One customer service to find out why, which is a pretty standard step.

Foreign Transaction Fees

For Capital One debit cards that aren't linked to 360 Checking accounts, foreign transaction fees might apply when you use them outside the United States. If you travel often, it's a good idea to check if your specific card has these fees, as they can add up. The 360 Checking debit card typically avoids these, which is a nice perk for international trips, apparently.

Overdraft Considerations

Capital One has policies for what happens if a transaction tries to overdraw your account. They will consider paying checks, ACH payments, and recurring debit card transactions that would cause your account to be overdrawn. You can also ask them to consider paying ATM and one-time debit card transactions that would lead to an overdraft. This means there's some flexibility, but it's always best to keep enough money in your account to cover your spending, which is a very sensible approach.

When You Need a New Card

Life happens, and sometimes you need a replacement debit card. Whether it's lost, expires, or gets damaged, Capital One has a process for getting a new one to you, which is pretty reassuring.

Lost, Expired, or Damaged Cards

If you lose your card, it expires, or it gets damaged, you'll need a replacement. Capital One will automatically send you a new card before your current one expires, which is quite helpful. If you haven't received a replacement card by the expiration date, it's a good idea to contact customer service to check on it, just to be sure, you know?

Tracking Your Replacement Card

If you've requested a new card, especially if you chose expedited delivery for a replacement, you can often see a tracker for your new Capital One card. It typically takes about 7 to 10 days for a new card to be delivered. If you don't receive it within 10 days, you should definitely reach out to Capital One, as they can help sort things out, which is pretty straightforward.

Extra Perks and Protections

Beyond just spending, your Capital One debit Mastercard can come with some additional benefits and protections that you might not even realize are there. These can add an extra layer of security and convenience to your financial life, which is always a bonus, you know?

Mastercard Benefits

As a preferred cardholder of a Capital One Debit Mastercard, you might have access to certain insurance, retail protection, and travel services. These can offer peace of mind for your purchases and when you're on the go. It's worth looking into what specific benefits your card offers, as they can vary slightly, but they are generally quite helpful.

Identity Theft Protection

To help keep your information safe, you can often enroll in Mastercard ID Theft Protection. This service monitors for suspicious activity that could indicate identity theft, giving you an early warning if something seems amiss. In today's world, having this kind of protection is a really smart move, providing an extra layer of security for your personal details, which is very important, apparently.

Frequently Asked Questions (FAQs)

Here are some common questions people ask about Capital One debit cards:

How do I activate my new Capital One debit card?

You can activate your new Capital One debit card online or by phone, which is a quick process that usually takes just a few minutes. You might need to set a PIN during this activation to complete it, which is pretty standard, you know?

Can I use my Capital One debit card at any ATM?

While Capital One debit cards are widely accepted, especially at the 70,000+ Capital One and partner ATMs, all Capital One ATMs require an activated debit card to access your 360 Checking account. You can use it at other ATMs too, but some might charge a fee, which is something to keep in mind, you know?

What happens if my Capital One debit card gets declined?

If your Capital One debit card is declined, it could be for a few reasons, like not enough money in your account, a security measure, or an issue with the place you're trying to pay. It's a good idea to check your account balance or contact Capital One customer service to find out the exact reason and sort it out, which is pretty much the first step to take.

Wrapping Things Up

A Capital One debit card, especially when paired with a 360 Checking account, is a really handy tool for managing your money every day. It offers a straightforward way to make purchases, get cash, and keep track of your spending without a lot of extra fuss. The convenience of digital payments, widespread ATM access, and the added protections make it a pretty solid choice for many people looking for an easy banking experience, which is actually a big deal for busy lives today. You can learn more about Capital One accounts on our site, and if you're ready to get started, you can also explore how to open a 360 Checking account today.

For more detailed information on Capital One's banking services, you might want to visit their official website, which is a good source for the most current details, you know? Capital One Official Website

- Ava Nicks Onlyfans Leaked

- North Andover Ma

- Steven A Smith Cowboys

- Jazz Vs Pelicans

- Georgetown Tigers Football

Some Capital One debit card users charged twice for purchases

Capital One Debit Card - Firstbankofthesouth

Viewing my virtual debit card on Capital One Desktop Examples | Page