Does The IRS Forgive Tax Debt From A Deceased Person? What Families Need To Know

When someone we care about passes away, it's a profoundly difficult time, full of grief and countless things to manage. So, the last thing anyone wants to think about is money matters, especially if it involves tax debts. You might be wondering, quite naturally, "Does the IRS forgive tax debt from a deceased person?" It's a question that brings a lot of worry and uncertainty to families during an already tough period, and the truth, it turns out, is a bit more involved than simply having debts disappear.

Many people assume that when a person is gone, their financial obligations, like debts, just vanish into thin air. That's a common thought, isn't it? Yet, when it comes to money owed to the government, particularly the Internal Revenue Service, things operate a little differently. This is a very common area of confusion, and it can add a lot of stress to those left behind, trying to sort out a loved one's affairs, you know?

This article aims to clear up some of that confusion. We'll explore what really happens with tax debts after someone passes on, who becomes responsible, and what steps might be necessary to address these financial duties. We'll also touch on situations where an estate isn't formally set up and discuss what options, if any, exist for easing the burden. Basically, we want to help you understand the landscape of tax debt for someone who has died, so you can feel a little more prepared, perhaps, for what lies ahead.

- What Nfl Team Is Moving To Las Vegas

- What Car Does Dolly Parton Drive

- Is Aishah Hasnies Religion

- What Percentage Of The Raiders Does Tom Brady Own

- Is Brian Kilmeade Still Going To Be On Fox And Friends

Table of Contents

- The Truth About Deceased Tax Debts

- When Does the IRS Offer Any Kind of Relief?

- What to Do If a Loved One Owes Taxes

- Common Questions About Deceased Tax Debt

- Conclusion

The Truth About Deceased Tax Debts

When someone leaves us, their tax debts don't just go away. This is a pretty important point, actually. While some types of money owed might disappear after a person dies, that's simply not the case for tax debts. Instead, that money now becomes a responsibility of the deceased person’s estate. The IRS, quite clearly, views this estate as the new entity responsible for settling any outstanding tax bills.

The estate, in this context, is basically all the property a person owned when they passed away. This can include everything from bank accounts and investments to real estate, like a family home. The IRS, it turns out, becomes one of the estate’s creditors, just like any other company or person the deceased might have owed money to. They have a claim on the estate’s assets to get their money back, you see.

In fact, the IRS often puts a lien on the estate for the amount owed. If the estate has things like a house, the lien might include that property. This means that before other bills get paid or inheritances get handed out, the tax debt usually needs to be taken care of. This process can sometimes cause frustrating delays for family members who are trying to sort everything out, which is pretty understandable, right?

- Where Is The 2028 Super Bowl

- Is The Nfl Getting Rid Of Jay Z

- Is Any Nfl Player A Billionaire

- What Car Does Howard Hamlin Drive

- What Teams Are Going To Las Vegas In 2025

Now, what happens if there isn't a formal estate set up? Dealing with IRS debt after someone passes away can be quite complex, especially when no official estate has been established to manage outstanding financial duties. This situation raises a lot of questions about who, if anyone, is responsible for the deceased person’s tax obligations. When an individual dies without an estate, resolving IRS debt becomes really challenging, in a way.

The IRS won't just forgive these debts after the taxpayer’s death. There's a statute of limitations for federal tax debts, which is generally ten years from the date the tax liability was assessed. This means the IRS has a decade to collect, but it doesn't mean the debt is forgiven just because the person is gone. It just defines how long they can pursue it, basically.

A particularly important point comes up if the tax debt was from a jointly filed return. In such cases, the surviving spouse becomes responsible for that debt. So, if you filed joint returns with your partner for several years and there was an unpaid amount, the IRS will collect that money from your spouse’s assets. This is a situation that can be very tough for the person left behind, obviously.

When someone with IRS tax debt dies, the debt doesn't just disappear. The IRS follows a specific process to settle the debt using the deceased person's estate. The estate, as we mentioned, is all the property collected after their death. This means the money or property in the estate is used to pay off the tax debt before anything else is distributed. It's a very clear order of operations, so to speak.

Generally, if there is no estate, that often means the deceased person was insolvent, meaning they didn't have enough assets to cover their debts. This can make the collection process even more complicated for the IRS, and for the family, too. It’s a situation that requires careful handling, as a matter of fact.

If taxes aren't filed for a deceased person, the IRS can take legal action. They might place a federal lien against the estate. This pretty much means you have to pay the federal taxes before you can close any other debts or accounts. If this isn't done, the IRS can demand the taxes be paid by the legal representative of the deceased. It's a serious matter, you know.

When we talk about debt being "forgiven" or "canceled," it usually means the amount owed is discharged for less than the full sum. This can happen with other types of debt, like credit cards or loans, but with the IRS, it’s a different story. Tax debt can sometimes be passed onto the estate after a family member passes. Understanding when this happens and what to do if you inherit tax debt is really important.

The IRS may pursue the collection of taxes from the estate if a deceased person owed taxes from prior years. The collection statute expiration date, or CSED, for taxes owed is 10 years after the date the tax liability was assessed. This is a key timeframe to keep in mind, as it defines the period during which the IRS can actively pursue collection efforts, apparently.

Federal tax debt, generally, must be taken care of when someone dies before any inheritances are paid out or other bills are settled. This can introduce frustrating time delays for family members, as the IRS prohibits inheritance disbursements until federal obligations are satisfied. It’s a way the system makes sure the government gets its due before others receive their share, basically.

When Does the IRS Offer Any Kind of Relief?

While the IRS doesn't just "forgive" tax debt because someone has passed away, there are specific situations where some form of relief might be possible. One such possibility is if the estate, or the person responsible for it, can prove a significant financial hardship. This might qualify them for something called "Currently Not Collectible" status. If granted, this status means the IRS agrees that you simply cannot pay the debt right now without severe difficulty, so they temporarily stop collection efforts. It's not forgiveness, but a pause, you know?

Another point to consider is that 10-year statute of limitations we mentioned earlier. In general, the Internal Revenue Service has ten years to collect unpaid tax debt. After that time passes, the debt is, in a way, wiped clean from their books, and the IRS writes it off. This is often called the 10-year statute of limitations. However, it's really important to understand that this ten-year clock can be paused or extended in certain situations, like if the IRS is trying to collect or if the taxpayer files for bankruptcy. So, it’s not an automatic "get out of jail free" card, but it's a timeframe to be aware of, obviously.

Sometimes, other creditors might forgive debt from a deceased person, even if there's no estate. For example, a bank might cancel a credit card debt. However, this doesn't automatically mean the IRS will forgive any tax implications related to that canceled debt. If a bank cancels a significant amount of debt, that canceled amount can sometimes be considered taxable income by the IRS, even for a deceased person. This can create a new tax liability that the estate would then be responsible for. It’s a pretty complex situation, to be honest.

So, while the IRS doesn't typically just wave a magic wand and make tax debt vanish when someone dies, there are specific pathways and timeframes that can influence how or if the debt is collected. These situations usually involve proving hardship or waiting for the collection period to expire, and even then, there are often conditions. It’s never as simple as just hoping it goes away, you know?

What to Do If a Loved One Owes Taxes

If you find yourself in the position of dealing with a loved one's affairs and discover they owed taxes, it can feel like a really heavy burden. The first step, generally, is to understand that you will likely need to file taxes for the deceased person. This includes their final tax return for the year they passed away, and possibly any unfiled returns from previous years. This is a very important part of settling their financial matters, as a matter of fact.

It's crucial to gather all relevant financial documents. This means looking for income statements, bank records, investment details, and any past tax returns. Having these documents organized will make the process much smoother, whether you handle it yourself or seek help. This can be a bit of a scavenger hunt, especially during a time of grief, but it’s quite necessary, you see.

One of the best pieces of advice is to seek professional help. Dealing with IRS debt after someone passes away, especially when there's no estate, can be really complex. Professionals who specialize in tax and estate matters can guide you through the process, help you understand the specific rules that apply to your situation, and make sure all the right steps are taken. This can save you a lot of headaches and potential issues down the road, too.

Taking proper steps from the beginning is very important. If the right actions aren't taken, the IRS can pursue recovery for years, potentially delaying the probate process or even affecting heirs. Understanding the specific responsibilities of an executor or personal representative is key. These individuals are typically tasked with managing the deceased person's assets and debts, including tax obligations, so it’s a pretty big job, actually.

For instance, if you are the executor, you'll need to understand how to settle IRS debt for a deceased person, whether there's a formal estate or not. This might involve communicating directly with the IRS, providing necessary documentation, and making arrangements for payment from the estate's funds. It's a process that demands attention to detail and a good grasp of tax procedures, which is why professional guidance can be so valuable, obviously.

Remember, the goal is to resolve the tax debt in a way that is compliant with IRS rules and minimizes any further stress on the family. This often means being proactive, getting accurate information, and not trying to ignore the situation. Ignoring it can lead to bigger problems down the line, which nobody wants, you know?

If you're unsure about where to start, or if the situation seems particularly overwhelming, reaching out to a tax professional or an estate attorney is a very sensible move. They have the experience and knowledge to help you navigate these often-tricky waters. It's about finding the right support to make a difficult time a little bit easier, so.

Common Questions About Deceased Tax Debt

People often have many questions when a loved one passes away, especially concerning their financial responsibilities. It’s a time filled with unknowns, and tax matters can feel particularly confusing. Let's look at some common questions that pop up, because understanding these can really help clarify things, you know?

Are unpaid taxes automatically forgiven at death, or do the heirs inherit the debt?

No, unpaid taxes are not automatically forgiven when someone dies. This is a really common misconception, but it's important to be clear on this point. Instead, the tax debt becomes a responsibility of the deceased person's estate. The estate, which includes all the assets and property the person owned, is primarily responsible for paying off any outstanding tax bills. Heirs generally do not inherit the debt personally, unless they were a surviving spouse on a jointly filed return, or if they somehow become responsible for the estate and its debts. So, the debt is tied to the assets, not usually the individual heirs, basically.

What happens if a deceased person owes taxes to the IRS but has no estate?

This is a challenging situation, actually. If a deceased person owes taxes but has no estate, it usually means they didn't have enough assets to cover their debts. In such cases, if there are truly no assets to claim, the IRS generally cannot collect the debt. However, it's not a guarantee. The IRS will investigate to confirm there are no hidden assets or overlooked property. Also, if there was a jointly filed return, the surviving spouse would still be responsible for the debt, even if the deceased person had no estate. It’s a very specific set of circumstances that determines if the debt goes uncollected, you see.

Does the IRS forgive tax debt after 10 years, even for a deceased person's estate?

The IRS generally has a 10-year statute of limitations to collect unpaid tax debt. After this period, the debt is typically written off their books. This rule applies to tax debts, regardless of whether the person is living or deceased. However, it's important to understand that this 10-year clock can be paused or extended under certain conditions. For instance, if the estate is in bankruptcy or if there are ongoing collection actions, the clock might stop. So, while there is a time limit, it's not an absolute guarantee that the debt will simply disappear after ten years, especially if the IRS has been actively pursuing it, obviously.

Conclusion

So, as we've seen, the idea that tax debt simply vanishes when someone passes away isn't quite right. The IRS doesn't just forgive tax debt from a deceased person. Instead, that financial responsibility typically shifts to the deceased person's estate. This means that any money owed to the government usually needs to be settled from the assets left behind before anything else is distributed to family members or other creditors. It's a critical part of closing out a loved one's financial life, you know?

We've talked about how the IRS becomes a creditor of the estate, how joint returns can make a surviving spouse responsible, and what happens when there's no formal estate. We also touched on the limited ways relief might be found, like the 10-year collection period or the "Currently Not Collectible" status, though these aren't automatic forgiveness. Dealing with these matters can feel overwhelming, especially during a time of loss, which is pretty understandable, right?

If you find yourself in this situation, remember that you don't have to figure it all out alone. Getting help from professionals who understand tax and estate laws can make a huge difference. They can guide you through the necessary steps, help you understand your specific situation, and make sure everything is handled correctly. Learning more about estate planning on our site can give you a head start, and you can also find specific guidance on filing taxes for a deceased loved one here. Taking these steps can bring a sense of peace during a very challenging time, basically.

- How Much Are 2026 Super Bowl Tickets

- Who Is The Lowest Paid Nfl Player

- What Football Team Is Worth The Least Money

- How Much Does Patrick Mahomes Make

- What Is The Age Difference Between Gutfeld And His Wife

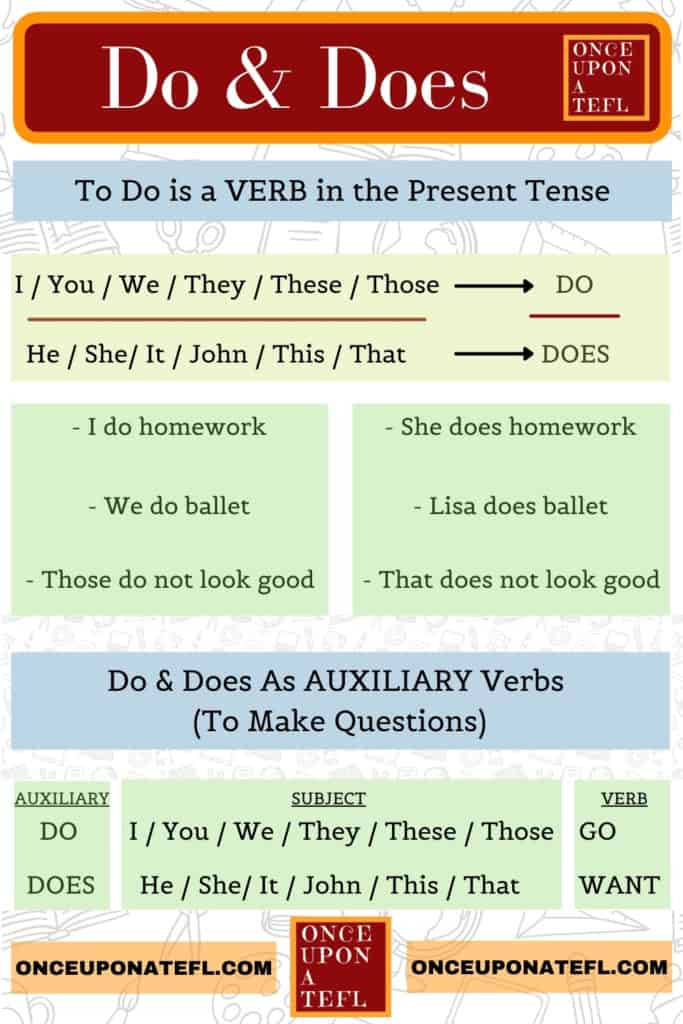

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES