504 Divorced Or Separated Individuals: Getting Your Taxes Right After A Split

Going through a divorce or separation can feel like a whole new world, full of changes and fresh beginnings. One area that often brings a lot of questions, you know, is how all of this affects your money matters, especially your taxes. It's a big shift, and figuring out the tax rules that come with a change in marital status can seem a bit much at first glance.

Many people find themselves wondering about things like their filing status, who claims the children, or what happens with payments exchanged between former partners. These are all really common concerns, and getting clear on them is a key step for anyone recently separated or divorced. So, it's almost like you're starting a new chapter, and understanding these financial pieces helps set a good foundation.

Luckily, there's a valuable resource out there that helps clear up much of this confusion for 504 divorced or separated individuals. This guide, which we'll talk about quite a bit, is specifically designed to help people just like you make sense of their tax responsibilities during this time. It really does offer a lot of useful information, helping you feel more in control of your financial picture.

- How Tall Is Jacqui Heinrich Weight Measurements

- How Much Is Tom Brady Worth In 2025

- What Is The Most Popular Nfl Team In The World

- How Many People Own The Raiders

- Who Is The Nfl Coach With 23 Year Old Girlfriend

Table of Contents

- Understanding IRS Publication 504: Your Go-To Guide

- Filing Status After a Split: What Changes?

- Dependents and Children: Who Claims What?

- Alimony and Property Settlements: Tax Insights

- Other Important Tax Considerations

- Getting Help with Your Tax Situation

- Frequently Asked Questions

Understanding IRS Publication 504: Your Go-To Guide

For anyone who is a 504 divorced or separated individual, IRS Publication 504 is, in fact, a truly important document. It's like a comprehensive manual put out by the Internal Revenue Service, specifically created to explain the tax rules that apply when you're no longer married or are living apart from your spouse. This publication helps you get a grip on all sorts of tax-related matters that come up after a marital change.

This resource, you know, goes over general filing information, different deductions you might be able to take, and other tax rules that are relevant for people in your situation. It's an excellent place to start if you're feeling a bit lost about how your new marital status impacts your federal taxes. The information inside is pretty clear, giving instructions on how to handle various tax situations.

The IRS makes sure to keep this publication updated, too. For instance, the 2022 version of Publication 504 for 504 divorced or separated individuals was released in January of that year, which is helpful. This means you can often find the latest information about things like claiming dependents, how property gets divided for tax purposes, and payment obligations. It's a living document, constantly reflecting changes, so you really should check for the most recent version, say, around tax time.

- Who Is The Highest Paid Nfl Player

- How Much Is The Raiders Owner Worth

- How Much Does Sam Altman Make A Year

- What Skin Color Was Aisha

- Did Heather Childers Get Married

It's worth noting that this publication also covers future developments and provides reminders about tax rules. It touches on topics like exemptions, qualified domestic relations orders, and even individual retirement arrangements, which can be affected by a split. This comprehensive approach means it pretty much covers a wide range of topics, helping you understand your obligations and opportunities.

Filing Status After a Split: What Changes?

One of the first things 504 divorced or separated individuals need to figure out is their correct filing status. This can be a bit different from what you were used to when married, so it's a good idea to pay attention here. Your filing status really does affect your tax rate and how much you might owe, or even get back, so getting it right is quite important.

The publication explains how to claim your filing status once you're divorced or separated. For example, if you and your husband weren't legally divorced or separated under a written agreement by the end of the year, then the special rules for children of divorced or separated parents might not apply to your situation, which is something to remember. This means your circumstances at the very end of the tax year play a big role in what status you can choose.

For many 504 divorced or separated individuals, the "head of household" status becomes a possibility, especially for the parent who has custody of the children. This status often comes with more tax breaks, which can be a real benefit. So, if you're the custodial parent, this is definitely something to look into, as it can make a noticeable difference in your tax outcome.

Understanding these options and which one applies to you is a key part of filing your tax return correctly. The publication goes into detail about the requirements for each status, helping you make the best choice for your personal situation. It's not always straightforward, but the guidance is there to help you sort it out, you know.

Dependents and Children: Who Claims What?

For 504 divorced or separated individuals with children, deciding who claims the children as dependents on their tax return is often a big question. The rules around this can seem a bit involved, but Publication 504 explains them pretty clearly. Generally, the parent with whom the child lived for the greater number of nights during the rest of the year after the separation is considered the custodial parent for tax purposes.

This "custodial parent" designation is quite significant because, as a matter of fact, that parent typically gets the bulk of the tax breaks associated with the children. This includes things like claiming the child as a dependent and potentially filing as head of household, which we just talked about. So, the number of nights a child spends with each parent truly matters for tax purposes.

When it comes to child support payments, the rules are very clear and, in a way, quite simple. Child support payments are not deductible by the person who pays them, and they are not taxable income for the person who receives them. This is a pretty important distinction to remember, as it differs from how alimony might be treated, for instance. This rule generally applies across the board, making it less complicated than some other areas of divorce-related tax.

The publication also covers various related forms and specific scenarios concerning dependents, making sure you have all the information you need to make the right claims. It's all about making sure you understand your responsibilities and your opportunities for tax benefits, which can certainly help ease some financial strain during this transition.

Alimony and Property Settlements: Tax Insights

When it comes to alimony, or spousal support, the tax rules have actually seen some changes over time, so it's important for 504 divorced or separated individuals to be aware of what applies to their specific agreement. Publication 504 provides detailed explanations about how alimony payments are treated for tax purposes. Historically, alimony payments could be deductible for the payer and taxable for the payee, but this rule has changed for agreements made more recently.

The publication clarifies how to handle alimony, helping you understand if the payments you receive or make are taxable or deductible based on when your divorce or separation instrument was put into effect. This distinction is really important for your overall tax picture, as it can significantly impact your income and deductions. It also explains what does and does not count as alimony for tax purposes, which can sometimes be a bit confusing, you know.

Property settlements are another key area covered for 504 divorced or separated individuals. The rules here are also quite specific. For example, any property received after July 18, 1984, under a divorce or separation instrument that was in effect after that date, generally falls under a specific tax rule. This rule also applies to other property received after 1983 if you and your spouse, or former spouse, made a special election, a section 1041 election, to apply this rule.

What this means, in short, is that transfers of property between spouses or former spouses due to divorce are usually not taxable events at the time of the transfer. So, for instance, if one person pays another $10,000 as part of a marital income division, that payment itself isn't directly taxed to the recipient as income. The publication goes into more detail, making sure you understand how these asset transfers affect your taxes, both now and potentially in the future.

Other Important Tax Considerations

Beyond filing status, dependents, alimony, and property, there are several other tax-related items that 504 divorced or separated individuals might need to think about. Publication 504 is quite thorough, covering many of these additional points. For example, it discusses individual retirement arrangements (IRAs) and how they might be affected by a divorce, which can be a big deal for long-term financial planning.

The costs associated with getting a divorce, too, are something people often wonder about in terms of tax deductibility. The publication provides information on what, if anything, related to these costs might be deductible. This can be a bit of a nuanced area, so having clear guidance is pretty helpful, to be honest. It helps you avoid making assumptions that could lead to tax issues later on.

Tax withholding and estimated tax payments are also covered. When your financial situation changes due to a separation or divorce, your income and deductions might shift significantly. This means you might need to adjust your tax withholding from your paycheck or start making estimated tax payments to avoid a surprise tax bill at the end of the year. The publication helps you understand how to manage these ongoing tax obligations, which is really quite practical.

For those living in community property states, the publication also explains how community property rules interact with divorce and separation for tax purposes. This can be a rather complex area, so having specific information tailored to these situations is quite beneficial. It helps ensure that both parties are clear on their responsibilities regarding shared income and assets during the separation period.

Getting Help with Your Tax Situation

Even with a resource as helpful as Publication 504, the tax rules for 504 divorced or separated individuals can still feel a bit overwhelming at times. There are so many details, and every personal situation is slightly different. That's why, in some respects, getting expert assistance can be a really smart move. Professionals who understand these tax rules can help you sort through everything and make sure you're making the best choices for your specific circumstances.

The publication itself even mentions how to get tax help, which is a good sign that the IRS recognizes the need for support. Whether it's a tax preparer, an accountant, or another financial advisor, having someone knowledgeable guide you through these tax implications can lead to a smoother transition to life after divorce. They can help you understand the nuances of your property division, alimony arrangements, and child custody agreements as they relate to your tax return.

For more detailed information, you can always refer to the official IRS Publication 504 directly. It's a great primary source for all the rules and guidelines we've talked about. And for general insights and more resources, you can always learn more about tax matters on our main page. We also have other helpful content; you can link to our tax resources page for more specific articles and tools.

Ultimately, taking the time to understand these tax implications, or getting help from someone who does, can really save you a lot of worry and potential issues down the line. It's about empowering yourself with knowledge during a significant life change, ensuring your financial foundation is as strong as possible as you move forward.

Frequently Asked Questions

What is IRS Publication 504 about?

IRS Publication 504 is a key resource that explains the tax rules for people who are divorced or separated from their spouse. It covers how to file your tax return, how to claim your filing status, and details about dependents, alimony, and property settlements, among other things. It's essentially a guide to help 504 divorced or separated individuals understand their tax obligations and opportunities.

How does divorce affect my tax filing status?

Your divorce or separation can change your tax filing status significantly. Publication 504 helps you figure out if you can file as single, head of household, or married filing separately, depending on your situation at the end of the tax year. For example, if you're the custodial parent, you might be able to file as head of household, which often comes with more tax breaks.

Are child support payments taxable or deductible?

No, child support payments are not deductible by the person who pays them, and they are not taxable income for the person who receives them. This is a very clear rule that applies to child support payments, making them different from how alimony might be treated for tax purposes.

- How Much Does Michael Strahan Make On Good Morning America

- Were Lalo And Howards Bodies Found

- What Car Does Michael Douglas Drive In The Game

- Why Did The La Raiders Change Their Name

- Who Will Be In The Super Bowl 2025

IRS Publication 504 – Divorced or Separated Individuals - Sessums Black

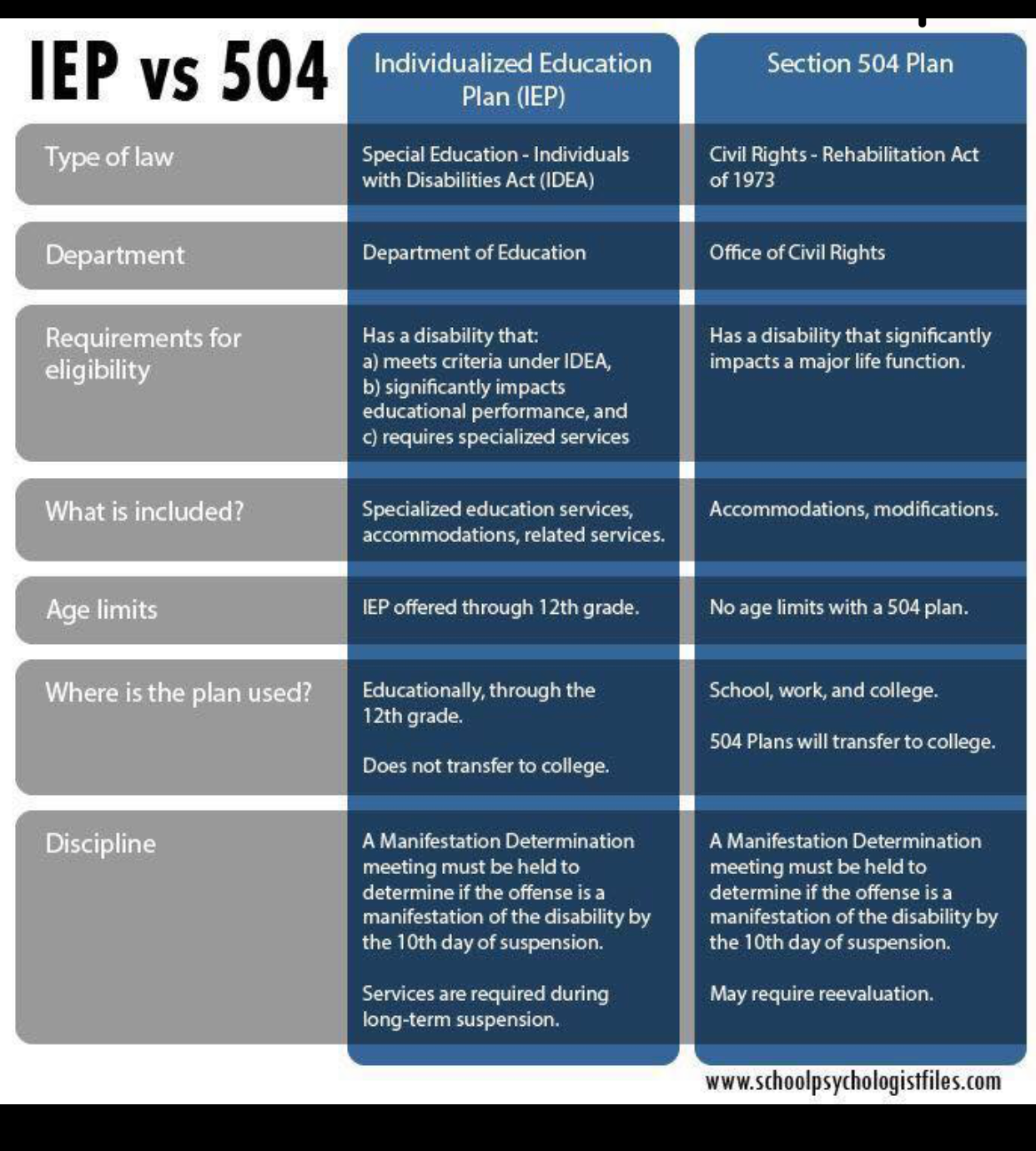

Section 504

Section 504 Plan — Garden City SEPTA