Amex Platinum Card Glitch: What You Need To Know About Those Quirky Benefits

Have you ever felt a bit puzzled by how your Amex Platinum card perks actually work? You are not alone, as a matter of fact. Many cardholders often find themselves wondering about the finer details, especially when it comes to things like airline credits or those statement credits that pop up. It is, you know, a card with a lot of moving parts, and sometimes those parts seem to operate in their own unique way.

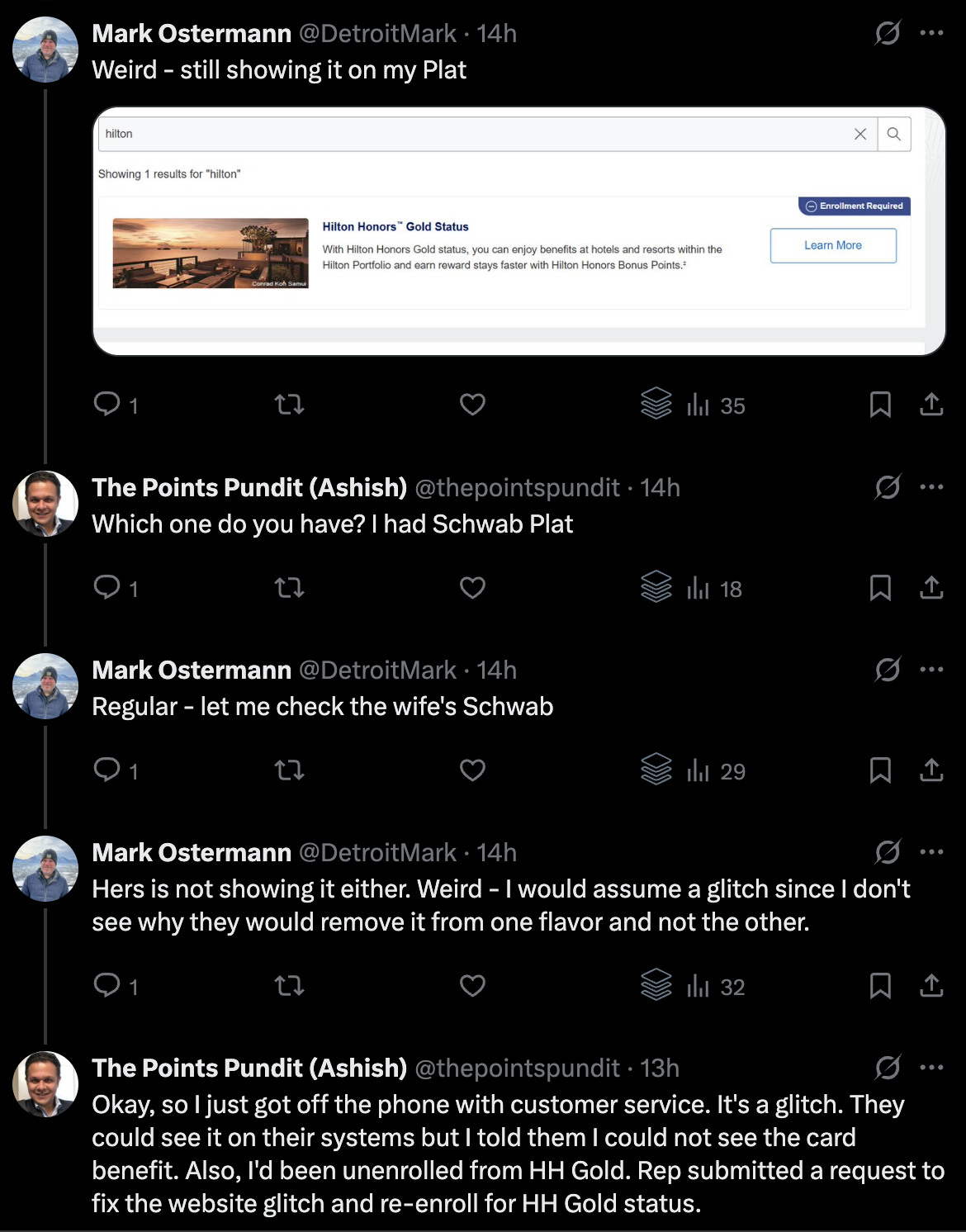

So, there is a lot of chatter out there, and some folks are calling it an "Amex Platinum card glitch." This isn't really a system breakdown, but more about the little quirks and specific timings that come with using your benefits. People are always trying to figure out if their airline choice for a credit rolls over into the next year, or if they can grab a TravelBank purchase right on the very first day of January. These are good questions, honestly.

This article will go into some of these common head-scratchers, drawing from real experiences and questions people have. We will look at how some of these benefits behave, whether it's about getting those Membership Rewards points or how specific airline credits get applied. It's all about making sense of what might seem like a small "glitch" but is really just a unique aspect of the card's operations.

- Richard Harrison Death Chumlee

- Luo Yunxi Relationships

- Grab My Balls

- Eminem Is A Clone

- Beau Marie St Clair

Table of Contents

- Understanding the Airline Credit Quirks

- Membership Rewards and Spending Targets

- Statement Credits and Their Unique Rules

- Getting Support for Your Amex Platinum

- Frequently Asked Questions About Amex Platinum Card Quirks

Understanding the Airline Credit Quirks

One of the most talked-about features of the Amex Platinum card is its airline fee credit. This credit, you know, helps offset incidental fees from your chosen airline. A common question that pops up, pretty often actually, is whether your airline selection carries over to the next year. This is a big deal for folks planning their travel budget. The general sense is that you pick an airline once a year, and that choice typically sticks for the entire calendar year. It's not something that usually just rolls over without you re-selecting it, so you might need to make a fresh choice when the new year begins.

TravelBank Purchases and Timing

Then there's the whole discussion around TravelBank purchases. People frequently ask, "Can I make a TravelBank purchase right on January 1st, or will I need to wait a day after?" This is a very specific timing question, and it speaks to how keen cardholders are to use their benefits as soon as they become available. Historically, many have found success making these purchases right at the start of the new year, but it can sometimes depend on how quickly the system resets or processes the new annual credit. It's, you know, a bit of a race to be first, but usually, it works out okay pretty quickly.

United Airlines TravelBank Data Points

For those who pick United Airlines, there is a lot of interest in TravelBank reimbursement. People are always sharing their experiences, trying to figure out the best way to get that credit back when buying United Airlines TravelBank funds with their Amex Platinum card. It's a rather useful way to use the credit, but it does require picking United as your airline for that specific perk. This is a key distinction, as some other cards, like the Hilton Aspire, have a different system where their quarterly credit applies more broadly, like directly towards airfare. So, it's not quite the same across all cards, which is something to keep in mind, obviously.

- How To Make A Woman Queef

- Full Bush In A Bikini Trend

- How To Make Fleshlight

- Vanessa Rae Adams

- R34 Honkai Star Rail

Membership Rewards and Spending Targets

Getting Membership Rewards points is a big draw for many Amex Platinum cardholders. You might recall hearing about offers like, "Amex Platinum spend $4,000 over next 90 days for 50,000 MR points." These kinds of offers are a fantastic way to earn a lot of points quickly, but they do come with a spending target you have to hit within a certain timeframe. For example, one person mentioned getting their card in September of 2022 and already spending 15,000 on it. That's a good amount of spending, and it shows how much some people use their card for everyday purchases and bigger expenses. It is, you know, about reaching those goals to get the rewards.

Sometimes, getting these offers can be a bit of a process. One person shared that the initial agent they spoke with had to transfer them to a different representative just to get the offer. This shows that sometimes you need to talk to the right person to get the specific deals you are looking for. It's not always a straightforward thing, but persistence can definitely pay off when you are trying to grab those extra Membership Rewards points. You really just have to be a bit patient, you know.

Once you have those points, how you use Membership Rewards points is completely up to you. There are so many possibilities, from booking travel through American Express Travel to transferring them to airline or hotel partners. You can explore all the possibilities and choose the rewards that are right for you. It's pretty cool, actually, how much flexibility you have with them.

Statement Credits and Their Unique Rules

Beyond the airline credit, the Amex Platinum card offers other statement credits that are quite valuable, but they also come with their own set of rules and timings. These credits are designed to give you value back on specific types of purchases, making the annual fee feel a bit more manageable. It's all about understanding when and how these credits apply to your account, so you don't miss out on any savings, you know.

Hilton Quarterly Credits

A good example is the "Quarterly $50 statement credit for stays with Hilton." This credit, you know, is split up throughout the year, giving you a little bit back each quarter when you stay at Hilton properties. It's a pretty nice perk for those who travel often and prefer Hilton. This structure means you can't just use it all at once; you have to plan your Hilton stays to align with the quarterly periods to get the full benefit. It's a bit different from a single annual credit, so that's something to keep in mind, obviously.

Upcoming Benefit Adjustments

It is also worth noting that benefits can change over time. There have been reports, for example, that as of July 1st, some benefits are changing. Blogs are reporting that a specific annual credit is shifting to a $150 annual credit, which might mean a net $250 loss for some, but also potentially $1000 off of something else. These kinds of adjustments are important to keep an eye on, as they can definitely affect the overall value you get from your card. It's always a good idea to stay updated on these things, and people often share their experiences as days go by, which is helpful, you know.

These changes are a part of how credit card products evolve. What was once a certain benefit might be adjusted to fit new trends or partnerships. So, while it might feel like a "glitch" or a sudden change, it's often a planned adjustment that Amex makes. Keeping an eye on official announcements and trusted sources is pretty important to stay informed about what's happening with your card's benefits, honestly.

Getting Support for Your Amex Platinum

When you have questions about your Amex Platinum card, getting good support is key. American Express offers a lot of ways to get help, whether it's through their help center, their mobile app, or by calling a representative. You can find answers to some of the most frequently asked questions and topics, which is pretty useful. It's, you know, a good place to start if you are trying to figure out a specific detail about your card's benefits or a charge on your account.

The official American Express app for iPhone, for example, allows you to access your account from anywhere. You can track spending and rewards, find offers, review your balance, and even pay your bill. This mobile access makes it really convenient to manage your card and keep an eye on those benefits and credits, so you are always in the know. It's a very handy tool, actually.

For more specific issues, like understanding how a certain credit applies or clarifying a spend requirement for points, sometimes a phone call is best. As one person mentioned, sometimes you need to be transferred to a different representative to get the right information or to activate a specific offer. This just means that the customer service team is specialized, and you might need to speak with someone who handles that particular type of inquiry. It's all part of the process, you know, to get the support you need.

If you are looking for more details about American Express services or want to explore different card options, you can always visit their main site. They have information about credit cards, business cards, and corporate cards. You can also learn more about the Membership Rewards program and other ways to pay. It is, you know, a comprehensive resource for all things Amex. You can learn more about Amex card benefits on our site, and link to this page for common credit card questions.

They also have information about their investor relations, careers, and global network, if you are interested in the company as a whole. It's pretty extensive, honestly, what they offer. You can find the best credit card by American Express for your needs, choosing between travel, cash back, rewards, and more. Applying for a credit card online is also an option, of course. For more general information about American Express, you can visit their official help page, which is a good place to start for any general inquiries.

Frequently Asked Questions About Amex Platinum Card Quirks

Here are some common questions people have about the Amex Platinum card's unique features:

Does the airline credit selection carry over to the next year?

Typically, your chosen airline for the incidental fee credit needs to be re-selected each calendar year. It's not something that automatically rolls over. So, you might need to make a fresh choice when January 1st arrives, to be honest.

Can I make a TravelBank purchase right on January 1st?

Many cardholders have found success making TravelBank purchases on January 1st itself, right when the new annual credit becomes available. However, processing times can vary a little bit, so while it often works, it's good to keep an eye on your statement. It's pretty common for it to work right away, though, you know.

What are the latest changes to Amex Platinum benefits, especially regarding the annual credit?

Recent reports suggest that as of July 1st, some annual credits are adjusting. For example, some blogs are reporting a change to a $150 annual credit, which might affect the net value for some cardholders, but it could also come with other new perks, like a $1000 discount on certain things. It's a good idea to check official Amex communications for the most up-to-date information, obviously.

An Amex Platinum Card 'glitch', has it affected you too? - TravelUpdate

Amex Platinum Card Design: Expert Insights and Features

USA Discover bank AMEX platinum card fake template in PSD format, fully